Union bank of india credit card offers various features and benefits, along with a simple application process. In today’s busy world, having a credit card can be highly beneficial in terms of convenience, security, and access to rewards programs.

Union bank of india understands this need and provides a range of credit cards to suit different customer requirements. These cards come with attractive features such as cashback offers, reward points, travel benefits, and insurance coverage. The application process is straightforward and can be done online or at a union bank branch.

Now, let’s delve deeper into the features, benefits, and application process of union bank of india credit card.

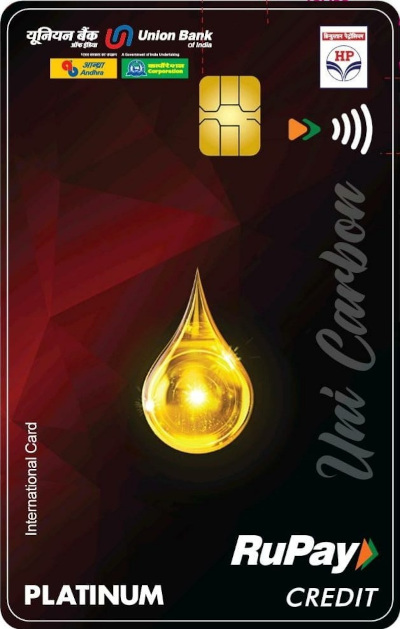

Credit: www.livemint.com

An Overview Of Union Bank Of India Credit Cards

Union bank of india offers a range of credit cards with attractive features and benefits. With a simple application process, customers can enjoy a host of privileges and rewards. Discover the benefits of union bank of india credit cards and find the perfect one for your financial needs.

Union bank of india offers a wide range of credit card options with fantastic features and benefits. These credit cards are designed to cater to the varying needs of individuals, making it easier for them to enjoy a convenient and rewarding shopping experience.

Let’s take a closer look at the union bank of india credit cards:

Introduction To Union Bank Of India Credit Cards

- Union bank of india credit cards provide customers with a range of options that suit their preferences and requirements.

- These credit cards are designed to offer exciting benefits, such as cashback offers, rewards points, fuel surcharge waivers, and more.

- Union bank of india credit cards come with a host of features, including contactless payments for a faster and more convenient transaction experience.

- With union bank of india credit cards, customers can access a wide network of atm and pos terminals, both domestically and internationally.

- Customers can also enjoy added security with features like sms alerts and zero lost card liability.

Range Of Credit Card Options Available

Union bank of india offers a diverse range of credit cards to cater to different customer needs. Let’s explore the various credit cards available:

- Union bank platinum credit card: This premium card is perfect for those who seek exclusive privileges and benefits.

- Enjoy accelerated rewards points for every spending, ensuring rewards can be redeemed faster.

- Avail of exciting offers on shopping, dining, entertainment, and travel.

- Access exclusive airport lounge facilities for a luxurious travel experience.

- Union bank signature credit card: Designed for the discerning customer looking for elevated rewards and unparalleled benefits.

- Earn premium rewards points that can be redeemed for a wide range of options, including shopping vouchers and air miles.

- Get access to premium travel assistance services and travel insurance coverage.

- Enjoy special discounts and offers on premium lifestyle brands.

- Union bank freedom credit card: Ideal for those who value flexibility and cashback rewards.

- Earn attractive cashback on a variety of spending categories, including groceries, fuel, and utility bills.

- Benefit from zero fuel surcharge and exclusive offers on dining, travel, and shopping.

- Enjoy complimentary access to select airport lounges.

- Union bank secure credit card: Tailored for customers who want to build or rebuild their credit history.

- Start building a credit history with union bank of india’s secure credit card.

- Use the card responsibly and improve your credit score over time.

- Enjoy the convenience of a credit card while you work towards financial stability.

No matter what your preferences or requirements may be, union bank of india has a credit card option to cater to your needs. By choosing a union bank of india credit card, you can enhance your shopping experience, enjoy attractive rewards, and avail of exclusive benefits.

Apply for a union bank of india credit card today for a convenient and rewarding financial experience.

Features Of Union Bank Of India Credit Cards

Union bank of india credit cards come with a range of features and benefits that make them an ideal choice for customers. From cashback rewards to travel privileges, these credit cards offer convenience and flexibility. The application process is simple and quick, ensuring a hassle-free experience.

Union bank of india offers a range of credit cards that come with a host of exciting features to enhance your shopping experience. Let’s explore some of the key features of union bank of india credit cards:

- Cashback and reward programs: Enjoy the benefits of cashback and reward programs offered by union bank of india credit cards. Earn cashback on your purchases and get rewarded with loyalty points that can be redeemed for exciting gifts and discounts.

- Special discounts and offers: With union bank of india credit cards, you gain access to exclusive discounts and offers at partner merchants. Avail special deals and enjoy savings on a wide range of products and services.

- Contactless payments: Union bank of india credit cards are equipped with contactless payment technology, allowing you to make quick and hassle-free transactions. Simply tap your card on a contactless-enabled terminal to complete your purchase securely.

- Global acceptance: Experience the convenience of worldwide acceptance with union bank of india credit cards. Accepted at millions of establishments worldwide, these cards ensure you can use them wherever you go, making them the perfect travel companion.

- Emi options: Union bank of india credit cards offer the flexibility of converting your high-value purchases into easy monthly installments. Choose from a range of affordable emi options to manage your finances more effectively.

- Secure transactions: Union bank of india credit cards prioritize the security of your transactions. With advanced security features such as emv chips and pins, you can enjoy peace of mind knowing that your financial information is protected.

Union bank of india credit cards not only provide a convenient mode of payment but also offer a plethora of benefits to suit your lifestyle needs. Whether it’s earning cashback, availing discounts, or enjoying secure transactions, these credit cards have got you covered.

Apply for a union bank of india credit card today and unlock a world of opportunities.

Benefits Of Union Bank Of India Credit Cards

Union bank of india credit cards offer a range of features and benefits, making them an attractive option for customers. With easy application process, these cards provide convenience and flexibility for everyday purchases and financial transactions. Enjoy rewards, discounts, and cashback offers while managing your finances effectively with union bank of india credit cards.

Union bank of india credit cards come with a range of benefits that make them a valuable financial tool for cardholders. Let’s take a closer look at some of these benefits:

Convenient Payment Options:

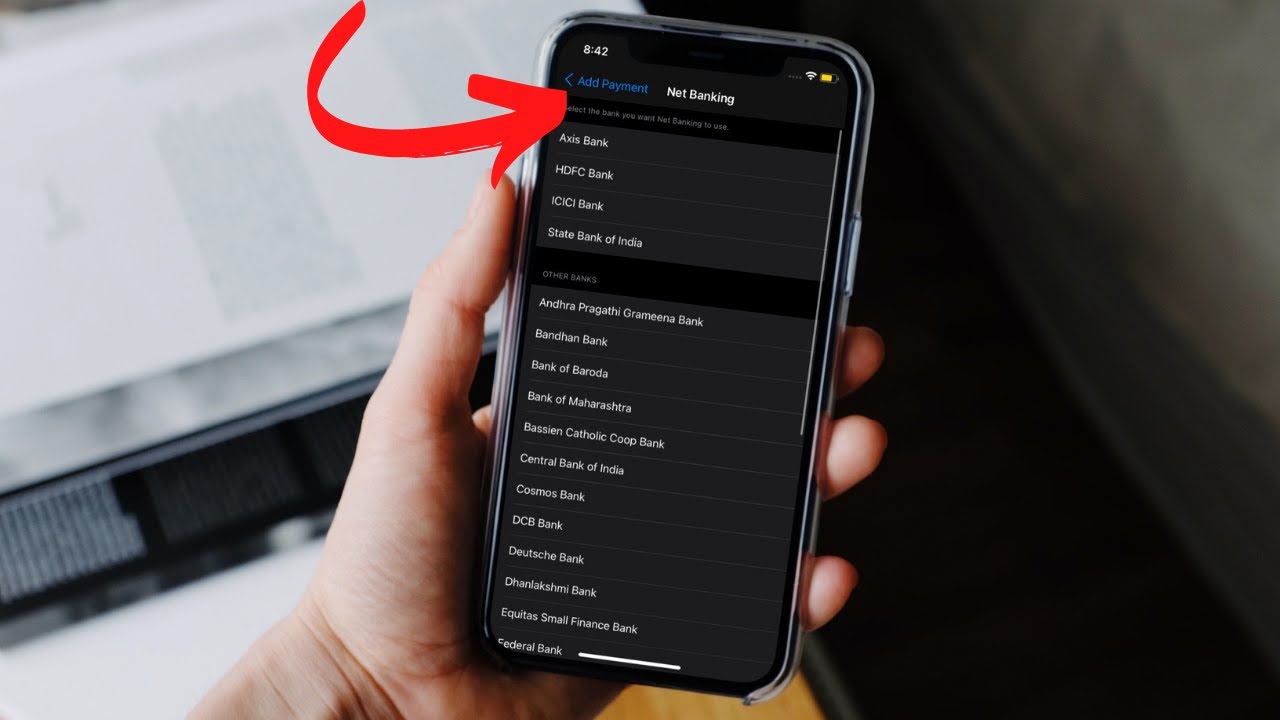

- Multiple payment channels: Union bank of india credit cards offer various convenient payment options, including online payment through net banking, mobile banking, and the bank’s official mobile app. This ensures that you can make your payments anytime and from anywhere, providing you with flexibility and convenience.

- Autopay facility: With the autopay facility, you can set up an automatic payment schedule for your union bank of india credit card. This ensures that your bills are paid on time, freeing you from the hassle of remembering due dates and avoiding late payment charges.

Increased Purchasing Power:

- Flexible credit limit: Union bank of india offers a range of credit cards with different credit limits to suit the varying needs and preferences of individuals. Having a higher credit limit allows you to make larger purchases and gives you the flexibility to manage your expenses effectively.

- Easy emi options: Union bank of india credit cards provide easy emi options for making purchases, allowing you to convert high-value transactions into affordable monthly installments. This enables you to manage your finances better and enjoy the convenience of paying for expensive items over a period of time.

Fraud Protection:

- Secure transactions: Union bank of india credit cards are equipped with advanced security features, making transactions safe and secure. Every transaction is encrypted to protect your personal and financial information from unauthorized access, providing you with peace of mind while making online or in-store purchases.

- Zero-liability policy: In case of any fraudulent transactions on your union bank of india credit card, you are protected by the bank’s zero-liability policy. This means that you won’t be held responsible for any unauthorized charges, ensuring that you are not financially impacted by fraudulent activities.

Travel And Lifestyle Benefits:

- Travel rewards: Union bank of india offers credit cards that come with travel rewards and benefits. These include air miles, hotel discounts, complimentary lounge access at airports, and travel insurance coverage. Avail these perks to enhance your travel experiences while enjoying cost savings and added convenience.

- Lifestyle privileges: Union bank of india credit cards offer a range of lifestyle benefits, such as dining discounts, movie ticket offers, shopping rewards, and access to exclusive events. These privileges enable you to indulge in your favorite activities and experiences while saving money and enjoying special perks.

Access To Exclusive Events And Experiences:

- Exclusive rewards program: Union bank of india credit cards often come with an exclusive rewards program that allows you to earn points on your card transactions. These points can be redeemed for a variety of rewards, including event tickets, shopping vouchers, and merchandise, giving you the opportunity to enjoy exclusive events and experiences.

- Priority booking: Some union bank of india credit cards offer priority booking benefits for concerts, shows, and other exclusive events. This means you get early access to tickets, giving you a better chance of securing seats for popular events before they sell out.

Union bank of india credit cards offer a range of benefits, including convenient payment options, increased purchasing power, fraud protection, travel and lifestyle benefits, as well as access to exclusive events and experiences. These features make union bank of india credit cards a valuable financial tool for individuals looking for convenience, flexibility, and rewards in their financial transactions and lifestyle choices.

Union Bank Of India Credit Card Application Process

Learn how to apply for a union bank of india credit card effortlessly and enjoy exclusive features and benefits. With a seamless application process, you can access a wide range of privileges tailored to your financial needs.

Union bank of india offers a range of credit cards suited to meet the diverse needs of its customers. If you’re interested in applying for a union bank of india credit card, this section will guide you through the application process.

Read on to learn about the eligibility criteria, required documents, online and offline application options, step-by-step application process, as well as some tips for a successful application.

Eligibility Criteria:

- You must be a resident of india.

- You should be at least 21 years old.

- Have a stable source of income.

Required Documents:

- Proof of identity: Aadhaar card, pan card, passport, voter id card, or driving license.

- Proof of address: Aadhaar card, passport, utility bill, or bank statement.

- Proof of income: Last 3 months’ salary slips/bank statements, it returns, or form 16.

Online And Offline Application Options:

You can choose to apply for a union bank of india credit card through either online or offline channels, depending on your preference and convenience.

- Online application: Visit the union bank of india website, navigate to the credit card section, and follow the instructions to complete the application form online. Upload the required documents and submit the application.

- Offline application: Alternatively, you can visit the nearest union bank of india branch, collect the credit card application form, fill it out, attach the required documents, and submit it to the bank officials.

Step-By-Step Application Process:

- Visit the union bank of india website or the nearest branch to access the credit card application form.

- Fill out the application form with accurate information, including personal details, contact information, employment details, income details, etc.

- Attach the required documents mentioned earlier to support your application.

- Double-check the form to ensure all the information provided is accurate and complete.

- Submit the application form along with the supporting documents either online or at the nearest union bank of india branch.

- Wait for the bank’s review and approval process. You may be contacted by the bank for further verification if necessary.

- Once your application is approved, you will receive your union bank of india credit card at your registered address within the given timeframe.

Tips For A Successful Application:

- Ensure all the information provided in the application form is accurate and matches the supporting documents.

- Double-check the eligibility criteria to make sure you meet the requirements.

- Submit all the necessary documents along with the application form to avoid delays or rejections.

- Maintain a good credit score by making timely payments and managing your debts effectively.

- Review the terms and conditions of the credit card you are applying for to understand its features, benefits, and fees.

With this comprehensive understanding of the union bank of india credit card application process, you can apply confidently online or through the nearest branch. Remember to meet the eligibility criteria, submit the necessary documents, and follow the step-by-step process for a successful application.

Tips For Choosing The Right Union Bank Of India Credit Card

When choosing a union bank of india credit card, consider its features, benefits, and application process. Ensure you select the right card that aligns with your financial needs and goals.

Union Bank Of India Credit Card: Features, Benefits, And Application Process

Whether you’re a frequent traveler, an avid shopper, or simply looking to build your credit, choosing the right credit card from union bank of india can make all the difference. With a range of options available, it’s important to analyze your personal spending habits, evaluate annual fees and interest rates, understand the reward programs, and consider additional cardholder benefits.

In this section, we will delve into the tips for selecting the perfect union bank of india credit card that suits your needs and preferences.

Analyzing Personal Spending Habits:

Understanding your spending habits is crucial in choosing a credit card that aligns with your lifestyle and financial goals. Take the following factors into consideration:

- Monthly expenses: Determine your average monthly expenses across various categories such as groceries, dining out, travel, and shopping.

- Payment patterns: Consider whether you prefer to pay off your balance in full each month or carry a balance over time.

- Credit utilization: Assess your current credit utilization to gauge how much of your available credit you typically use.

Evaluating Annual Fees And Interest Rates:

Before committing to a union bank of india credit card, it’s essential to evaluate the annual fees and interest rates associated with each card option. Consider the following:

- Annual fees: Some credit cards may come with an annual fee, so it’s important to determine if the benefits outweigh the cost.

- Interest rates: Compare the interest rates offered by different cards, especially if you anticipate carrying a balance. Look for cards with competitive interest rates.

Understanding Reward Programs:

Union bank of india credit cards often offer enticing reward programs. Keep the following in mind:

- Rewards structure: Look into the rewards structure of each credit card, including the earning potential for various categories such as travel, shopping, or dining.

- Redemption options: Assess the flexibility and options for redeeming your rewards, ensuring they align with your preferences and lifestyle.

Considering Additional Cardholder Benefits:

In addition to rewards, many union bank of india credit cards come with additional cardholder benefits. Pay attention to:

- Travel perks: Some cards offer travel benefits such as airport lounge access, travel insurance, and concierge services.

- Shopping privileges: Explore any exclusive shopping discounts, cashback offers, or extended warranty protection that may come with the credit cards.

Keep these tips in mind when choosing a union bank of india credit card to ensure that you’re selecting a card that suits your spending habits, offers valuable rewards, and provides additional benefits. By evaluating your personal needs and preferences, you can find a credit card that truly enhances your financial journey.

Union Bank Of India Credit Card Fees And Charges

The union bank of india credit card comes with various features and benefits. From cashback rewards to fuel surcharge waivers, customers can enjoy a host of advantages. To apply for a union bank of india credit card, simply follow the easy application process.

Discover the fees and charges associated with the card.

Credit card fees and charges play a crucial role in determining the overall cost of ownership and usage. As a discerning customer, it’s essential to fully understand the fees and charges associated with the union bank of india credit card before making a decision.

Let’s take a closer look at the various fees and charges involved:

Annual Fees And Renewal Charges:

- Joining fee: Inr 500 (applicable for certain union bank of india credit cards)

- Annual fee: Inr 499 (for most union bank of india credit cards)

- Renewal fee: Inr 499 (charged annually)

Interest Rates On Purchases And Cash Advances:

- Interest-free period: Up to 50 days, applicable only if the outstanding amount is paid in full

- Interest rate on purchases: Ranges from 3.10% to 3.50% per month

- Interest rate on cash advances: Varies from 3.10% to 3.50% per month

Late Payment And Over-Limit Fees:

- Late payment fee: Inr 100 to inr 750, depending on the outstanding balance

- Over-limit fee: Inr 300, applicable when the credit limit is exceeded

Foreign Currency Transaction Fees:

- Foreign currency mark-up fee: 3.5% on the transaction amount, applicable for international transactions

Understanding the fees and charges associated with your union bank of india credit card empowers you to make informed decisions regarding your spending and repayment habits. It is crucial to carefully review all the terms and conditions provided by the bank to avoid any unnecessary expenses.

By staying aware of the fees and charges, you can maximize the benefits and rewards of using your union bank of india credit card while keeping your finances in check.

Union Bank Of India Credit Card Customer Support

Union bank of india credit card’s customer support is readily available to assist you with any queries or concerns. With its unique features, benefits, and a hassle-free application process, union bank of india credit card is an excellent choice for managing your financial needs.

When it comes to managing your union bank of india credit card, you can rely on their efficient and accessible customer support. Whether you have a query or need assistance with any credit card-related concern, union bank of india is ready to assist you with their 24/7 customer helpline.

24/7 Customer Helpline

- Union bank of india offers a dedicated customer helpline that is available 24 hours a day, 7 days a week.

- If you have any questions regarding your credit card, billing statements, transactions, or any other credit card-related matter, you can reach out to the customer helpline for assistance.

- The customer helpline is staffed by knowledgeable and friendly representatives who are ready to provide you with prompt and reliable support.

- Whether you need information regarding your credit limit, rewards program, or any other credit card feature, the customer helpline is just a phone call away.

Online Account Management

- Union bank of india provides an easy and convenient way to manage your credit card account online.

- By accessing their secure online portal, you can view your credit card statements, transaction history, and available credit limit.

- You can also make payments, check due dates, and set up automatic bill payments for added convenience.

- Union bank of india’s online account management system ensures that you have complete control over your credit card account anytime and anywhere.

Reporting Lost Or Stolen Cards

- In the unfortunate event of a lost or stolen credit card, union bank of india offers a seamless process to report and block your card.

- You can swiftly report the incident to the customer helpline, who will guide you through the necessary steps to safeguard your account.

- Promptly reporting a lost or stolen card helps prevent any unauthorized transactions and ensures the security of your funds.

- Union bank of india takes the necessary measures to help you recover your lost card and provide a replacement if needed.

Disputing Unauthorized Transactions

- If you notice any unauthorized or suspicious transactions on your union bank of india credit card statement, it is essential to take immediate action.

- The customer support team will guide you through the process of disputing unauthorized transactions so that you can protect your finances.

- By promptly reporting any discrepancies, union bank of india ensures that necessary steps are taken to investigate and resolve the issue.

- They understand the importance of timely resolution and strive to provide you with a hassle-free experience when disputing unauthorized transactions.

Union bank of india’s customer support is committed to providing prompt assistance and resolving any concerns you have regarding your credit card. With their 24/7 customer helpline, convenient online account management, efficient reporting of lost or stolen cards, and seamless process for disputing unauthorized transactions, you can experience peace of mind and excellent service.

Union Bank Of India Credit Card Faqs

Discover all the essential information about union bank of india credit card features, benefits, and application process in the frequently asked questions (faqs) section. Find out everything you need to know before applying for this credit card.

Frequently Asked Questions About Credit Cards

Here are some common queries related to union bank of india credit cards, along with answers and solutions to customer concerns:

- What are the eligibility criteria to apply for a union bank of india credit card?

- To apply for a union bank of india credit card, you must be an indian resident and meet the age requirements set by the bank. You will also need to provide supporting documents such as proof of identity, address proof, and income proof.

- How can i apply for a union bank of india credit card?

- You can apply for a union bank of india credit card both online and offline. Online, you can visit the official website of the bank and fill out the application form. Alternatively, you can visit a union bank of india branch near you and submit the required documents along with the application form.

- What are the different types of union bank of india credit cards available?

- Union bank of india offers a range of credit cards tailored to suit different needs. Some of the popular types include gold credit cards, platinum credit cards, and signature credit cards. Each card comes with unique features and benefits, giving you flexibility in choosing the one that suits you best.

- What are the key features and benefits of union bank of india credit cards?

- Union bank of india credit cards offer a host of features and benefits, including cashback and reward points on transactions, complemented by discounts and offers across various merchant outlets. You can also enjoy travel benefits such as complimentary airport lounge access and travel insurance coverage, depending on the type of credit card you choose.

- Are there any annual fees associated with union bank of india credit cards?

- Yes, most union bank of india credit cards come with an annual fee. However, the fee varies depending on the type of card. Some cards may offer a waiver of the annual fee based on spending thresholds or other criteria. It is important to check the terms and conditions of the specific credit card you are interested in to know the applicable fees.

- Can i track my union bank of india credit card application status?

- Yes, you can track the status of your credit card application by visiting the official union bank of india website and using the application tracking feature. Simply enter the required details to know the progress of your application.

- How can i manage my union bank of india credit card online?

- You can conveniently manage your union bank of india credit card online through the bank’s internet banking portal or mobile banking app. This allows you to check your credit card balance, review recent transactions, make payments, and even set up alerts for due dates and other important notifications.

- How can i make credit card payments for my union bank of india credit card?

- Union bank of india offers various payment options for credit cardholders. You can make payments through internet banking, mobile banking, neft/imps transfers, or by visiting a union bank of india branch. Additionally, you can set up auto debit instructions for timely payment of your outstanding balance.

- What should i do if my union bank of india credit card is lost or stolen?

- In such cases, it is important to immediately report the loss or theft of your credit card to union bank of india’s customer care hotline. They will guide you through the process of blocking the card and assist you in obtaining a replacement card.

- How can i redeem the reward points earned on my union bank of india credit card?

- Union bank of india provides various options for redeeming your credit card reward points. You can redeem them for a range of exciting gifts, merchandise, vouchers, or even convert them into cashback. The redemption process can be done through the bank’s designated redemption portal or by contacting customer support.

These frequently asked questions and answers aim to address some of the common queries related to union bank of india credit cards. If you have any specific concerns or additional questions, it is advisable to reach out to union bank of india directly for further assistance.

Frequently Asked Questions Of Union Bank Of India Credit Card: Features, Benefits, And Application Process

What Are The Features And Benefits Of A Credit Card?

Credit cards offer various features and benefits for users. These include convenient payment options, easy access to funds, and the ability to make purchases online or in-store. With a credit card, you can enjoy the flexibility of paying off your balance over time, rather than all at once.

Additionally, credit cards often come with rewards programs, where you can earn points, cashback, or travel miles for your purchases. Many credit cards also offer additional perks such as insurance coverage, extended warranties, and fraud protection. Moreover, credit cards can help build your credit history and improve your credit score if used responsibly.

This can be beneficial when applying for future loans or mortgages. Overall, credit cards provide a convenient and secure method of payment while offering a range of benefits and rewards for users.

How To Know If You Are Approved For Union Bank Credit Card?

To know if you’re approved for a union bank credit card, you can check your application status. Simply log in to your account on the union bank website and navigate to the credit card section. There, you’ll find information about your application, including whether it has been approved.

If you prefer to speak with someone directly, you can also contact union bank’s customer service. They will be able to provide you with the status of your credit card application. Keep in mind that the approval process can take some time, so be patient and regularly check for updates.

What Is Union Bank Of India Credit Card?

Union bank of india credit card is a financial product provided by union bank of india. It is a card issued by the bank that allows users to make purchases on credit. With a union bank of india credit card, users can conveniently shop online or at physical stores and pay later.

It offers various features and benefits such as rewards, cashback, and discounts on specific purchases. Union bank of india credit cardholders also enjoy the convenience of secure and contactless payments through nfc technology. The bank provides different types of credit cards catering to various needs and lifestyles.

Users can apply for a union bank of india credit card online or visit a branch to avail this financial facility. It’s a convenient solution for making purchases and managing expenses while enjoying additional benefits and security.

Which Card Is Best In Union Bank Of India?

The best card in union bank of india is the union bank credit card. It offers various benefits and features that cater to different needs. The card provides rewards for every transaction, such as cashback, discounts, and reward points, making it a convenient option for shopping and other expenses.

The union bank credit card also offers exclusive privileges like airport lounge access, fuel surcharge waivers, and insurance coverage. With its wide acceptance across merchants worldwide, it ensures seamless transactions wherever you go. Union bank of india provides different types of credit cards, including lifestyle, travel, and shopping cards, allowing you to choose the one that suits your requirements the most.

Enjoy the flexibility and convenience that union bank credit card offers for all your financial needs.

Conclusion

The union bank of india credit card offers a range of features and benefits that make it a valuable financial tool. With its wide acceptance, convenient online application process, and varying types of cards to suit different needs, union bank ensures that its customers have access to a credit card that aligns with their lifestyle and financial goals.

From cashless transactions to attractive reward programs, union bank’s credit cards provide flexibility and convenience for everyday transactions. Moreover, the added security features and zero-liability protection offer peace of mind to cardholders. Whether you’re a frequent traveler or a shopaholic, the union bank of india credit card has something to offer everyone.

It’s a reliable financial companion that not only provides purchasing power but also helps you save more with its exclusive rewards and offers. Apply for a union bank credit card today and experience the convenience and benefits it brings to your financial journey.