Option chains are versatile and powerful financial units, that can, to begin with, seem complex and daunting to novices. But, information and navigating the option chain is important for a successful option to buy and sell. In this article, we intend to simplify the idea of Option chains, making it accessible and smooth to recognize for those new to the arena of options trading. Check more on demat account kaise khole

Know the basics

What’s an Option chain?

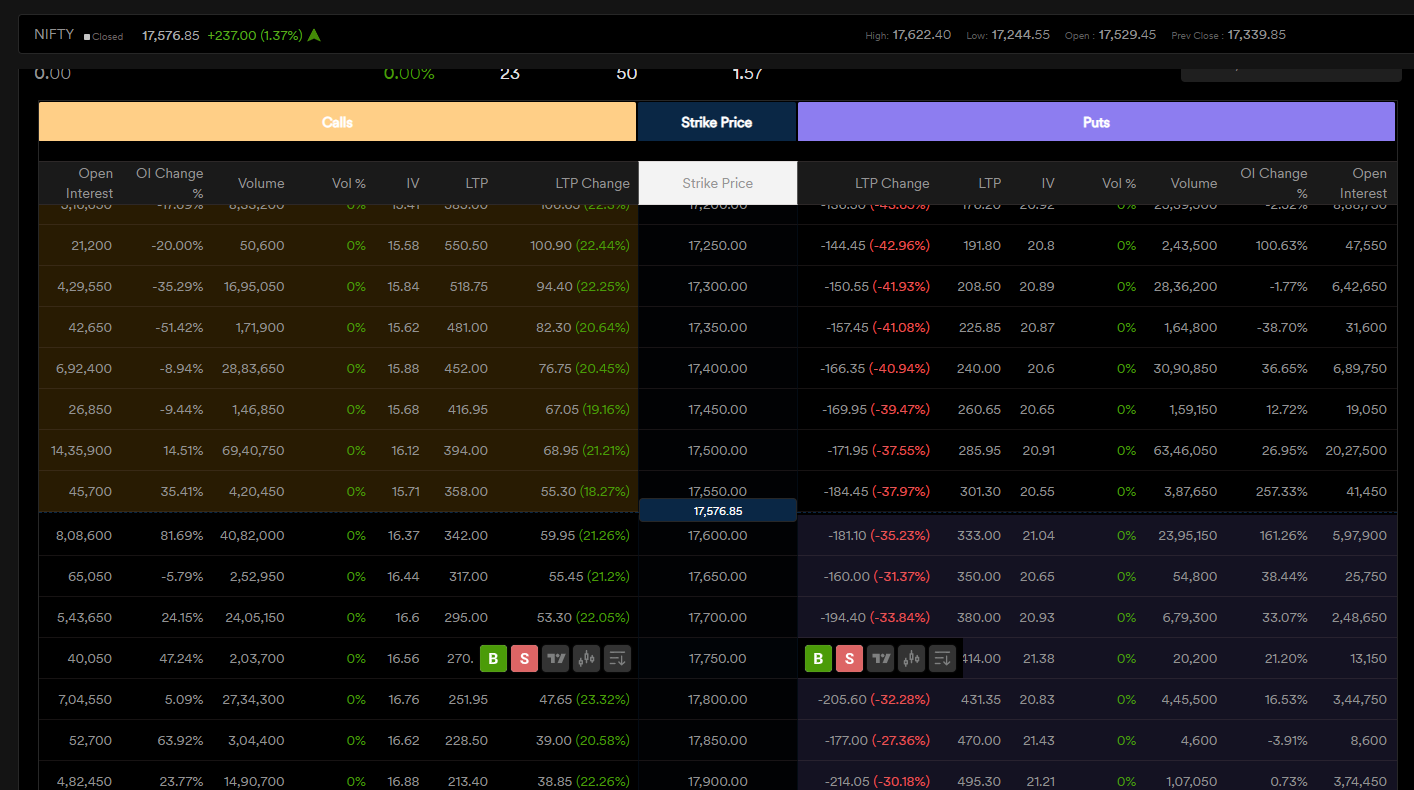

An Option chain is a visible illustration of to-be-had choice contracts for a specific underlying asset, organized by expiration date and strike fee. It affords a complete view of call-and-put options, showcasing their respective prices, quantity, open hobby, and other applicable information. Check more on demat account kaise khole

Key elements of an option chain

Expiration Date: The date till which the choice is legitimate.

Strike price: The price at which the option chain holder should buy (for call alternatives) or promote (for positioned options) the underlying asset.

name alternatives: alternatives that permit the holder to shop for the underlying asset at a selected strike fee. Check more on demat account kaise khole

put alternatives: options that allow the holder to sell the underlying asset at a specific strike price.

Bid and Ask fees: the very best fee a customer is inclined to pay (bid) and the lowest fee a dealer is inclined to just accept (ask) for the option.

Navigating the Option chain

Choosing the Underlying Asset

start by choosing the underlying asset (e.g., inventory, index, ETF) for which you need to change alternatives. Check more on demat account kaise khole

Check Expiration Dates

option contracts have expiration dates, typically at the third Friday of the expiration month. Pick out an expiration date that aligns with your buying and selling method.

Identifying calls and putting options

Inside the Option chain, call alternatives are generally displayed on the left facet, and positioned options are on the right side. Each Option chain contract includes records which include its image, ultimate charge, bid, ask, extent, and open interest. Check more on demat account kaise khole

Analyzing Strike expenses

Strike charges are prepared from lowest to highest. Typically, alternatives are classified into 3 corporations: in-the-cash (ITM), at-the-money (ATM), and out-of-the-money (OTM) alternatives.

ITM alternatives: Have strike costs favorable in comparison to the contemporary market fee.

ATM alternatives: Have strike charges closest to the cutting-edge market charge.

OTM alternatives: Have strike costs much less favorable compared to the modern-day market price. Check more on demat account kaise khole

Reviewing Bid and Ask costs

The bid rate is the most rate a customer is willing to pay for the choice, while the ask price is the minimum price a vendor is inclined to just accept. The difference between the bid and ask prices is called the bid-ask spread.

Know-how extent and open interest

extent represents the variety of Option chain contracts traded, even as open interest is the overall wide variety of wonderful contracts. better extent and open hobby indicate extra liquidity and dealer interest in a specific choice. Check more on demat account kaise khole