Canara bank customer id is a unique identifier used for locating and using online services. To access your canara bank online services, you need to locate your customer id.

Here’s a concise guide on how to find and utilize it effectively. Introducing new online banking services, including managing finances, making transactions, and accessing account information has become an integral part of modern banking systems. Canara bank, one of the largest public sector banks in india, offers a range of convenient online services to its customers.

To access these services, you need to have your canara bank customer id. We will guide you on how to locate and make optimum use of your customer id for hassle-free and secure online banking. So, let’s get started!

Credit: housing.com

Locating Your Canara Bank Customer Id

Looking for your canara bank customer id? Easily locate and use it for a seamless online banking experience. Access a range of services hassle-free with your unique customer id.

Finding the customer id on your bank statement:

- Check your bank statement for the customer id information.

- Look for a section labeled “customer id” or “account details.”

- The customer id is usually mentioned along with other account information, such as the account number and account type.

Locating the customer id on your passbook:

- Open your passbook and flip through the pages until you find the account information section.

- Look for a section labeled “customer id” or “account details.”

- The customer id is generally mentioned along with other account information, like the account number and account type.

Retrieving the customer id through online banking:

- Log in to your canara bank online banking account.

- Navigate to the account dashboard or profile section.

- Look for a section labeled “customer id” or “account information.”

- The customer id should be displayed here.

Remember, your canara bank customer id is a unique identifier that helps the bank recognize and manage your account. It is essential for accessing a range of online banking services.

Using Your Canara Bank Customer Id For Online Services

Locate and make use of your canara bank customer id to access a wide range of online banking services conveniently and securely. Experience hassle-free transactions and manage your finances with ease through this essential identification number.

Logging into your canara bank account with your customer id:

- Your canara bank customer id is your key to accessing your account online.

- To log in, visit the canara bank website and click on the “login” button.

- Enter your customer id and password in the designated fields.

- Once logged in, you’ll have access to a range of online services.

Accessing account information and transaction history:

- With your canara bank customer id, you can easily view your account information.

- Once logged in, navigate to the “account summary” section to see your current balance and account details.

- To check your transaction history, select the “transactions” tab and specify the desired date range.

- You can view details of all your transactions, including credits, debits, and other relevant information.

Performing online transactions with your customer id:

- Your canara bank customer id enables you to perform a variety of online transactions.

- To transfer funds to another account, select the “fund transfer” option.

- Enter the recipient’s account details, the amount, and any additional information required.

- Confirm the transaction using the one-time password (otp) sent to your registered mobile number.

- For bill payments, simply choose the “bill payments” option and follow the prompts to complete the transaction.

Updating personal information using your customer id:

- It’s important to keep your personal information up to date, and your canara bank customer id makes it easy to do so.

- From your account dashboard, click on the “profile” or “settings” option.

- Choose the section you wish to update, such as address, phone number, or email.

- Enter the new information and save the changes.

- Always ensure the accuracy of your personal details to ensure smooth banking services.

Remember, your canara bank customer id is a unique identifier for your online banking activities. Keep it secure and never share it with anyone. Utilize the convenience of online services to manage your canara bank account efficiently.

Security Measures For Canara Bank Online Services

Canara bank ensures robust security measures for its online services, including the use of customer ids. These ids are essential for accessing various digital banking features, providing customers with a secure and convenient experience.

Setting Up A Strong Password For Your Online Account:

- A strong and secure password is your first line of defense when it comes to protecting your canara bank online account.

- Choose a password that is unique and not easily guessable by others.

- Include a combination of upper and lowercase letters, numbers, and symbols to increase the complexity of your password.

- Make sure your password is at least 8 characters long, but the longer the better.

- Avoid using common words, personal information, or easily identifiable patterns in your password.

- Regularly update your password to prevent unauthorized access to your account.

Enabling Two-Factor Authentication For Added Security:

- Two-factor authentication (2fa) provides an extra layer of security for your canara bank online account.

- By enabling 2fa, you will be required to provide a second form of verification, such as a unique code sent to your registered mobile number or email address, in addition to your regular password.

- This helps to ensure that even if someone gains access to your password, they cannot log in without the second verification.

- To enable 2fa, go to your account settings and follow the instructions to link your mobile number or email address for verification.

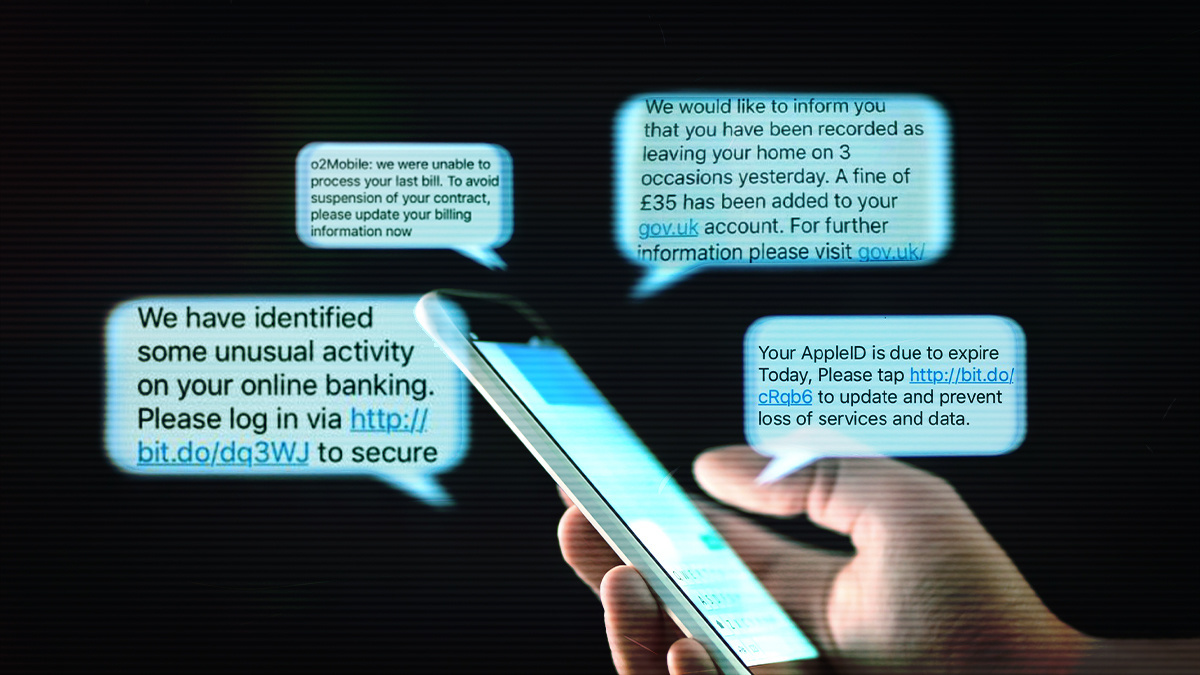

Recognizing And Avoiding Phishing Attempts:

- Phishing is a fraudulent practice used by scammers to trick individuals into sharing their sensitive information, such as login credentials or banking details.

- Be cautious of unsolicited emails, messages, or phone calls that ask for your personal information or direct you to a suspicious website.

- Always verify the authenticity of the source by contacting canara bank directly before providing any information.

- Canara bank will never ask you to provide your password, pin, or other sensitive details through email or phone.

- Look out for signs of phishing, such as poor grammar and spelling errors in communication.

- If you suspect that you have received a phishing attempt, report it to canara bank immediately and avoid clicking on any suspicious links or downloading attachments.

Remember, taking these security measures seriously is crucial for safeguarding your canara bank online account. By setting up a strong password, enabling two-factor authentication, and being vigilant against phishing attempts, you can enhance the security of your online banking experience.

Stay protected and enjoy the convenience of canara bank’s online services.

Troubleshooting Common Issues With Customer Id

Looking for help with troubleshooting common issues related to your canara bank customer id? Find out how to locate and use your customer id for seamless access to online banking services.

Recovering A Forgotten Or Lost Customer Id

It’s not uncommon to forget or misplace important login details, including your canara bank customer id. If you find yourself in this situation, don’t worry! Canara bank provides a simple process to help you recover your forgotten or lost customer id.

Here are the steps to follow:

- Visit the canara bank website and navigate to the login page.

- Click on the “forgot customer id” link, usually located below the login form.

- Next, you will be prompted to enter your registered mobile number and email address.

- Once you provide this information, canara bank will verify your identity.

- You will then receive an otp (one-time password) on your registered mobile number and email address.

- Enter the otp in the designated field on the website.

- After verifying the otp, you will be able to view your customer id on the screen.

- Make sure to note down your customer id and keep it in a safe place for future reference.

Recovering your forgotten or lost canara bank customer id is a straightforward and secure process. By following these steps, you can quickly regain access to your online banking services.

Resolving Login Errors With Your Customer Id

Encountering login errors when trying to access your canara bank online services can be frustrating. However, these issues can often be resolved with a few simple troubleshooting steps. Here are some common login errors you might face and how to resolve them:

- Incorrect customer id: Ensure that you are entering your customer id correctly, including any uppercase or lowercase letters. Double-check for any typos or errors.

- Forgotten password: If you have forgotten your password, use the “forgot password” option on the login page. Follow the instructions to reset your password and regain access to your account.

- Account lockout: If you have entered incorrect login credentials multiple times, your account may be temporarily locked for security reasons. Wait for a specific duration or contact canara bank customer support for assistance.

- Browser compatibility: Ensure that you are using a browser that is compatible with canara bank’s online banking portal. Clear your browser cache and cookies or try accessing the website from a different browser.

- Internet connection: A stable and reliable internet connection is essential for smooth online banking. Check your internet connection or try accessing the canara bank website from a different device.

By troubleshooting these common login errors, you can address the issue swiftly and continue enjoying the convenience of canara bank’s online services.

Contacting Canara Bank Customer Support For Assistance

If you are facing issues with your customer id or experiencing difficulties beyond the scope of self-resolution, contacting canara bank’s customer support can provide the necessary guidance and assistance. Here are the ways to get in touch with canara bank customer support:

- Customer care helpline: Dial canara bank’s toll-free customer care helpline at 1800 425 0018 or 1800 103 0018 to speak with a customer service representative. You can seek assistance for any account-related queries, including issues with your customer id.

- Branch visit: Visit your nearest canara bank branch and approach the customer service desk. The branch staff will be able to help you with any concerns you may have regarding your customer id or online services.

- Online support: If you prefer online communication, you can reach out to canara bank’s customer support through their official website. Fill out the contact form with relevant details and submit your query. A customer support representative will respond to your inquiry in a timely manner.

By reaching out to canara bank customer support, you can receive expert assistance to resolve any customer id issues or other concerns related to your online banking services.

Remember, canara bank is committed to providing excellent customer service and ensuring a seamless banking experience for its users.

Other Online Services Offered By Canara Bank

Canara bank offers a range of other online services, including the ability to locate and use your customer id for convenient online transactions. Easily access and manage your canara bank account with just a few clicks.

Canara bank not only provides convenient and secure banking services through its internet banking platform but also offers a range of other online services to cater to its customers’ diverse needs. These services include mobile banking features and benefits and canara bank’s mobile app functionalities.

Let’s delve into these online services in detail:

Mobile Banking Features And Benefits

Mobile banking has become increasingly popular among banking customers due to its convenience and accessibility. Canara bank understands this and provides a range of features and benefits to enhance the mobile banking experience. Here are some key highlights:

- Balance enquiry and mini statement: Customers can easily check their account balance and view mini statements directly from their mobile devices, eliminating the need to visit a branch or atm.

- Fund transfers: Canara bank allows customers to transfer funds instantly between their own accounts or to other beneficiaries within the bank. This feature enables hassle-free money transfers within minutes.

- Bill payments: With canara bank’s mobile banking, customers can conveniently pay utility bills, credit card bills, and other recurring payments directly from their mobile phones. This eliminates the need to stand in long queues or remember multiple due dates.

- Mobile recharge: Canara bank’s mobile banking platform allows customers to recharge their prepaid mobile phones anytime, anywhere. This feature ensures uninterrupted connectivity without the hassle of visiting physical recharge outlets.

- Investment services: Customers can also access various investment services through canara bank’s mobile banking app. From mutual fund investments to stock trading, the app provides a seamless platform for managing investments on the go.

Canara Bank’S Mobile App And Its Functionalities

Canara bank’s mobile app is specifically designed to provide a user-friendly and intuitive banking experience. The app offers a wide range of functionalities to simplify banking tasks and empower customers. Here are some notable features:

- Account management: Customers can view their account details, including balances, transaction history, and account statements, through the mobile app. This real-time access to account information ensures transparency and easy monitoring.

- Card management: The app allows customers to manage their debit and credit cards efficiently. They can block or unblock cards, set spending limits, and instantly generate card statements, making card management hassle-free.

- Cheque book request: Canara bank’s mobile app enables customers to request a new cheque book with just a few taps on their screens. This feature saves time and eliminates the need to visit a branch or fill out physical forms.

- Locate branches and atms: The app includes a branch and atm locator, making it convenient for customers to find the nearest canara bank branch or atm whenever required.

- Security features: Canara bank’s mobile app is equipped with robust security measures, such as biometric authentication and secure pin-based login, to ensure the safety of customer data and transactions.

In addition to these mobile banking features, canara bank also offers internet banking services, which provide even more comprehensive online banking solutions.

Remember, with canara bank’s online services, banking becomes easier, faster, and more convenient. Embrace the power of technology and enjoy seamless banking experiences at your fingertips.

Canara Bank’S Information Security Measures

Canara bank implements robust information security measures to safeguard customer data and ensure a secure online banking experience. Locate and use your canara bank customer id for convenient access to a range of online services.

Canara bank is committed to providing a secure and reliable online banking experience for its customers. With a focus on information security, the bank implements various measures to safeguard customer data and ensure privacy. Let’s explore some of canara bank’s information security measures:

Encryption And Secure Data Transmission:

- Canara bank employs robust encryption techniques to protect customer data during transmission. This ensures that any information shared between the customer’s device and the bank’s servers is encrypted and cannot be accessed by unauthorized individuals.

- The use of secure socket layer (ssl) technology ensures a secure connection between the customer’s web browser and canara bank’s online banking platform. This encryption technology provides an extra layer of security, preventing any potential data breaches or unauthorized access.

- By encrypting customer data, canara bank ensures that sensitive information such as login credentials, transaction details, and personal information remains confidential and secure.

Monitoring And Detection Of Suspicious Activities:

- Canara bank has implemented advanced monitoring systems that continuously analyze customer transactions and activities. These systems help detect any suspicious or unusual activities, such as fraudulent transactions or unauthorized access attempts.

- Through real-time monitoring, canara bank can swiftly identify and respond to potential security threats, minimizing the risk of financial fraud or account breaches.

- In addition to automated monitoring, canara bank has dedicated security teams that actively monitor and investigate suspicious activities, ensuring a prompt response to any potential security incidents.

Protecting Customer Data And Privacy:

- Canara bank puts the privacy of its customers at the forefront of its information security measures. The bank strictly adheres to privacy regulations and best practices to ensure that customer data is protected.

- Canara bank implements access controls and authentication mechanisms to prevent unauthorized access to customer accounts and information. This includes the use of unique customer ids, passwords, and additional security layers such as one-time passwords (otp) for certain transactions.

- As part of its commitment to customer privacy, canara bank maintains strict confidentiality protocols for handling customer data. The bank has implemented data protection measures and restricted access to customer information to authorized personnel only.

Canara bank takes information security seriously and implements various measures to protect customer data and privacy. Encryption and secure data transmission, monitoring and detection of suspicious activities, and protecting customer data are core elements of canara bank’s information security framework.

These measures are crucial in providing customers with a secure online banking experience.

Additional Online Banking Features Offered By Canara Bank

Canara bank offers a range of additional online banking features to enhance the convenience and accessibility for customers. These features include online fund transfers, bill payments, account statement downloads, and much more. Locate and use your canara bank customer id to access these services seamlessly.

Online Fund Transfers And Payments

- Canara bank offers a range of online banking features that make fund transfers and payments hassle-free and convenient.

- With your canara bank customer id, you can easily transfer funds to other canara bank accounts or to accounts in other banks.

- You can make quick payments for various services, such as utility bills, credit card bills, insurance premiums, and more.

- Online fund transfers and payments can be done effortlessly from the comfort of your home or office, saving you valuable time and effort.

Applying For Loans And Investment Products Online

- Canara bank provides the convenience of applying for loans and investment products online, eliminating the need for multiple visits to the bank.

- Whether you need a home loan, personal loan, car loan, or any other type of credit, you can submit your application online and track its status.

- Canara bank’s online platform also allows you to explore and invest in a variety of investment products, such as fixed deposits, mutual funds, and insurance policies.

- By availing these services online, you have the freedom to compare different loan and investment options, ensuring that you make informed decisions.

Requesting Account Statements And Other Documents

- Canara bank’s online banking features offer the convenience of requesting account statements and other important documents with just a few clicks.

- You can easily access your account statements for a specific period, helping you keep track of your transactions and manage your finances effectively.

- With your canara bank customer id, you can also request other documents like interest certificates, tax deduction certificates, and account closure letters online.

- This eliminates the need to visit the bank in person, saving you time, and providing you with quick access to the information you need.

Canara bank’s online banking features go beyond basic account management. With features like online fund transfers and payments, applying for loans and investment products online, and requesting account statements and other documents, canara bank strives to provide a seamless and user-friendly banking experience to its customers.

Frequently Asked Questions Of Canara Bank Customer Id: Locating And Using It For Online Services

What Should I Put In My Canara Bank Customer Id?

To access your canara bank account online, you need to enter your customer id. This id is a unique identification number provided by the bank to each customer. It helps authenticate your identity and grants you access to various online banking services.

When entering your customer id, make sure to input the correct sequence of numbers and characters as provided by the bank. This id acts as a username or login id for your online banking account. By entering the correct customer id, you can securely manage your finances, check your account balance, transfer funds, and perform other essential banking activities through canara bank’s online platform.

What Is Customer Id In Canara Bank Online?

Customer id in canara bank online is a unique identification number given to every customer who has an account with canara bank. It helps the bank in identifying and verifying the customer’s details and transactions. The customer id is essential for accessing various services offered by canara bank through their online banking platform.

With this id, customers can log in to their online banking account, perform transactions, view account statements, and access other banking services. It is important to keep the customer id confidential to ensure the security of the account.

Where Do I Find Customer Id In Canara Bank App?

To find your customer id in the canara bank app, follow these simple steps: 1. Open the canara bank app on your device. 2. Log in to your account using your username and password. 3. Once you are logged in, navigate to the “profile” or “my account” section.

4. In this section, you will find your customer id listed. 5. Take note of the customer id for future reference. By following these steps, you can easily locate your customer id in the canara bank app.

What Is A Canara Bank Customer Id?

A canara bank customer id is a unique identification number assigned to each customer of canara bank. It is used to access online banking services and perform various transactions.

Conclusion

Understanding and effectively utilizing your canara bank customer id is crucial for accessing and utilizing their online services. By following the steps outlined in this blog post, you can easily locate your customer id and use it to perform various banking transactions online.

Whether it’s checking your account balance, transferring funds, paying bills, or accessing other banking services, having your customer id handy allows for seamless and convenient online banking experiences. Additionally, being aware of the security measures required to protect your customer id and personal information is vital in safeguarding yourself from fraudulent activities.

With the increasing digitization of banking services, having a strong grasp of your customer id is a valuable tool for staying on top of your financial management. So, don’t hesitate to reach out to canara bank or explore their online platforms if you have any questions or concerns regarding your customer id.