Dcb bank’s net banking provides a comprehensive guide to online banking, offering convenience and security for users to manage their finances online. We will explore the various features and benefits of dcb bank net banking, as well as provide step-by-step instructions to get started.

Whether you want to check your account balance, transfer funds, or make bill payments, dcb bank’s net banking platform has got you covered. Stay tuned to discover how easy and hassle-free it is to bank online with dcb bank.

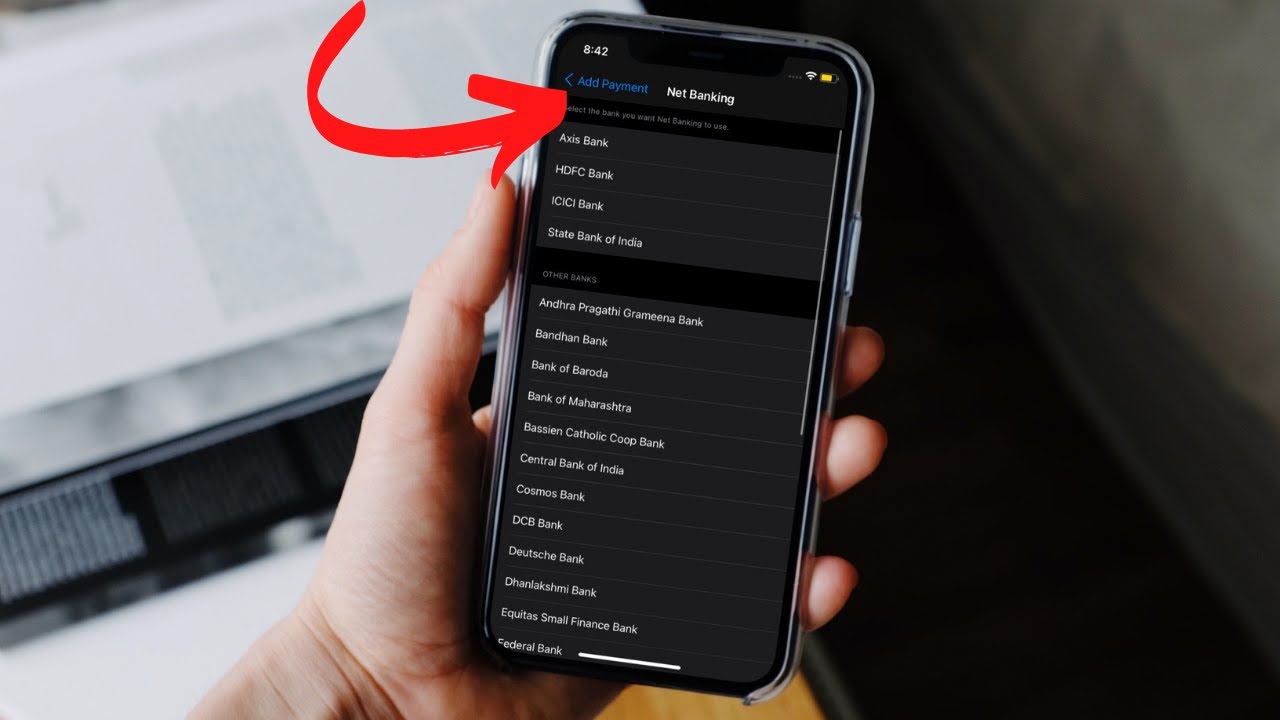

Credit: paytm.com

Understanding Dcb Bank Net Banking

Dcb bank net banking allows users to access and manage their accounts online, providing a convenient and reliable way to handle financial transactions. This comprehensive guide offers step-by-step instructions on using the platform for efficient online banking.

Dcb bank net banking provides customers with a convenient way to manage their finances online. Whether you want to check your account balance, transfer funds, or pay bills, this service offers a host of features to make your banking experience seamless.

Let’s delve into the details of dcb bank net banking and how you can benefit from it.

Benefits Of Using Dcb Bank Net Banking

- Easy account access: With dcb bank net banking, you can access your bank account anytime and anywhere, eliminating the need to visit a physical branch.

- Secure transactions: The platform ensures high-level security measures, protecting your sensitive information during online transactions.

- Fund transfers: Dcb bank net banking allows you to transfer funds instantly to other bank accounts within india. It’s a hassle-free way to make payments or send money to family and friends.

- Online bill payments: Say goodbye to standing in long queues to pay bills. Dcb bank net banking enables you to conveniently pay your utility bills, credit card bills, and other necessary payments online.

- Account statement and transaction history: Get a comprehensive overview of your account activity and statements with just a few clicks. It’s an excellent tool for tracking your expenses and managing your financial goals.

- Mobile banking: Take advantage of dcb bank’s mobile banking app to carry out banking tasks on the go. Whether you have an android or ios device, the app provides a user-friendly interface for easy access to your accounts.

- Customizable alerts: Set up personalized alerts and notifications to stay updated on your account activity. Receive alerts for credit or debit transactions, due dates, and account balance updates to stay in control of your finances.

How To Enrol For Dcb Bank Net Banking

To start using dcb bank net banking, follow these simple steps:

- Visit the official dcb bank website and locate the “net banking” section.

- Click on the “register” or “new user” option.

- Fill in the required details, including your account number, customer id, and registered mobile number.

- Create a unique username and password for logging into your dcb bank net banking account.

- Set up security questions and answers for added protection.

- Agree to the terms and conditions and submit the registration form.

- You will receive an otp (one-time password) on your registered mobile number. Enter this otp to complete the registration process.

- Once registered, you can log in to dcb bank net banking using your chosen username and password.

Logging In To Dcb Bank Net Banking

Follow these steps to log in to your dcb bank net banking account:

- Go to the dcb bank website and locate the “net banking” section.

- Click on the “login” or “existing user” option.

- Enter your username and password in the designated fields.

- Solve the captcha or security challenge, if prompted.

- Click on the “login” button to access your dcb bank net banking account.

Now that you understand the benefits of dcb bank net banking, how to enroll for it, and how to log in, you can start enjoying the convenience and efficiency of managing your finances online. Say goodbye to lengthy paperwork and hello to hassle-free banking at your fingertips!

Exploring Dcb Bank Net Banking Features

Dcb bank net banking offers a range of convenient features for hassle-free online banking. From fund transfers to bill payments, account statements to balance inquiries, this complete guide provides you with everything you need to know about navigating the world of digital banking with dcb bank.

Dcb bank net banking offers a wide range of features that make managing your finances online convenient and hassle-free. From checking your account balance to updating your contact details, here is a detailed guide to the key features of dcb bank net banking:

Account Balance And Statements:

- Easily check your account balance with just a few clicks.

- Access your account statements for a detailed view of your transactions.

- Use the balance inquiry feature to view the balance of your linked accounts as well.

Fund Transfers And Payments:

- Transfer funds instantly to other dcb bank accounts or accounts with other banks.

- Make neft, rtgs, and imps payments easily.

- Initiate recurring payments or schedule one-time payments for added convenience.

- Quick transfer of funds to your own accounts or to third-party accounts, both within india and internationally.

Bill Payments And Recharges:

- Pay utility bills, such as electricity, water, and gas, directly through net banking.

- Recharge your mobile phone, dth, and other prepaid services without any hassle.

- Set up standing instructions to automatically pay your bills on time.

Requesting Cheque Book And Stop Payment:

- Place requests for a new cheque book effortlessly through net banking.

- Stop payment on a cheque that has been issued but not yet cleared.

Updating Contact Details And Email Id:

- Keep your contact details up to date by editing your phone number, address, and email id.

- Easily add or modify email ids for receiving important notifications and alerts.

Managing Debit And Credit Cards:

- Block or unblock your debit or credit card in case of loss or theft.

- Set spending limits on your card to manage expenses.

- View and download your card statement for easy reconciliation.

Setting Alerts And Notifications:

- Stay informed about your account activities through convenient email and sms alerts.

- Set notification preferences for various transactions and account activities.

- Receive alerts for low balance, fund transfers, card transactions, and more.

With these comprehensive features, dcb bank net banking ensures that you have complete control over your finances online. From managing your account balance and making payments to updating your contact details and managing your cards, all your banking needs are just a click away.

Start exploring the power of dcb bank net banking today!

Securing Your Dcb Bank Net Banking Account

Learn how to secure your dcb bank net banking account with this comprehensive guide. Discover essential tips and best practices to ensure the utmost safety of your online banking transactions.

With the convenience of online banking comes the responsibility to safeguard your dcb bank net banking account from potential threats. By taking a few simple precautions, you can enjoy safe and secure digital banking. Here are some key measures to protect your account:

Password And Pin Security:

- Create a strong and unique password for your dcb bank net banking account.

- Use a combination of letters, numbers, and special characters in your password.

- Avoid using easily guessable information, such as your name or birthdate, as your password or pin.

- Change your password regularly to minimize the risk of unauthorized access.

- Remember to keep your password confidential and avoid sharing it with anyone.

Two-Factor Authentication:

- Enable the two-factor authentication feature provided by dcb bank net banking.

- This additional layer of security requires you to input a one-time password (otp) sent to your registered mobile number or email address.

- Two-factor authentication adds an extra level of protection against unauthorized login attempts.

Strong Password Practices:

- Avoid using the same password for multiple accounts.

- Consider using a password manager to securely store and generate strong passwords.

- Be cautious of phishing attempts that may trick you into revealing your password.

- Regularly monitor your account activity for any suspicious transactions or login attempts.

Recognizing And Reporting Fraudulent Activities:

- Stay alert and be vigilant about any signs of fraudulent activities.

- Be cautious of unsolicited emails, messages, or phone calls asking for personal or financial information.

- Regularly review your account statements and transactions to identify any unauthorized activities.

- If you suspect any fraudulent activity, immediately report it to dcb bank’s customer support.

Taking these necessary steps to secure your dcb bank net banking account will give you peace of mind when conducting your online banking transactions. By implementing strong password practices, enabling two-factor authentication, and staying vigilant against fraudulent activities, you can confidently embrace the convenience of digital banking.

Remember, your account security is in your hands.

Frequently Asked Questions Of Dcb Bank Net Banking: A Complete Guide To Online Banking

How Do I Activate Dcb Bank Net Banking?

To activate dcb bank net banking, follow these simple steps: 1. Visit the dcb bank website. 2. Click on the “first time user” link. 3. Fill in the required details like account number, registered mobile number, and pan. 4. Set up your user id and password.

5. Accept the terms and conditions. 6. Authenticate your identity through a secure code sent to your registered mobile number. 7. Create a new password for future logins. 8. Once you have successfully completed these steps, your dcb bank net banking will be activated.

Please note that you may be required to visit your nearest dcb bank branch for further verification or to complete any additional formalities as per the bank’s policy.

What Is The User Id And Password For Dcb Bank?

To access your dcb bank account, you will need to create a user id and password. These credentials can be obtained by registering for online banking through the bank’s official website. Once you have completed the registration process, you will receive an email with instructions on how to set up your user id and password.

Make sure to choose a strong password that includes a combination of letters, numbers, and special characters to enhance the security of your online banking experience. With your user id and password in hand, you can log in to your dcb bank account and manage your finances conveniently from anywhere at any time.

How Do I Complete Net Banking?

To complete net banking, follow these steps: 1. Visit your bank’s website and look for the net banking login option. 2. Click on the option and enter your username and password provided by the bank. 3. Once logged in, navigate to the funds transfer section and select the type of transfer you want to make, such as intrabank or interbank transfer.

4. Fill in the required details, such as the beneficiary’s account number and the amount to be transferred. 5. Confirm the transaction details and proceed with the transfer. 6. Some banks may require additional steps, such as entering an otp (one-time password) received on your registered mobile number for security purposes.

7. After completing the transaction, you will receive a confirmation message or email. 8. Remember to log out properly and keep your login credentials secure. By following these steps, you can easily complete net banking transactions.

How Do I Register For Dcb Mobile Banking?

To register for dcb mobile banking, follow these simple steps: 1. Download the dcb mobile banking app from your app store. 2. Open the app and click on “register” on the homepage. 3. Fill in your personal details such as your name, mobile number, and email address.

4. Set up a password and a secret question for security purposes. 5. Accept the terms and conditions and click on “submit. ” 6. You will receive an otp (one-time password) on your registered mobile number. 7. Enter the otp to verify your identity and complete the registration process.

8. Once registered, you can log in to the dcb mobile banking app using your registered mobile number and password. 9. Enjoy the convenience of banking services at your fingertips, including transferring funds, paying bills, and more. Registering for dcb mobile banking is quick and easy, so you can start managing your finances anytime, anywhere.

Conclusion

Online banking has become a necessity in today’s fast-paced world, and dcb bank net banking is certainly a reliable option. With the convenience it offers, customers can easily access their accounts, transfer funds, pay bills, and manage their finances from the comfort of their homes or on the go.

The wide range of features and security measures provided by dcb bank ensures a seamless and secure online banking experience. Whether you are a tech-savvy millennial or a retiree embracing digital banking, dcb net banking caters to all age groups and user preferences.

The user-friendly interface, efficient customer support, and robust security measures make online banking with dcb bank a preferred choice. So, why wait? Embrace the power of technology and enjoy the unlimited benefits of dcb bank net banking. Start your journey towards hassle-free online banking today!