Decoding oriental insurance company limited: get insights on policies and benefits, including coverage and advantages, in a simple and concise way. With a wide range of policies catered to different needs, oriental insurance offers various benefits that provide financial security and peace of mind.

From health insurance to motor insurance, oriental insurance ensures comprehensive coverage, affordable premiums, and efficient claim settlements, making it a reliable choice in the insurance market. Understanding the policies and benefits offered by oriental insurance is essential for individuals and businesses looking for reliable and trustworthy insurance coverage.

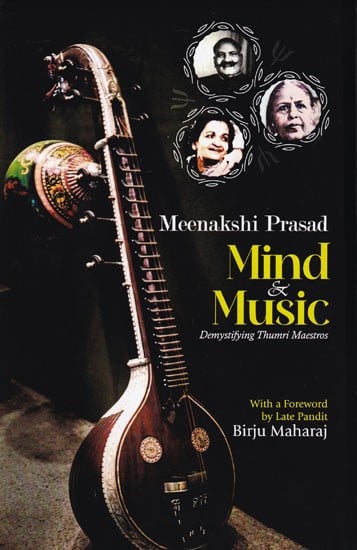

Credit: issuu.com

Understanding The History And Background Of Oriental Insurance Company Limited

Oriental insurance company limited has a rich history and background that is worth understanding. Take a closer look at their policies and benefits to make an informed decision.

Origin And Establishment Of Oriental Insurance Company Limited

The story of oriental insurance company limited begins with its establishment in the year 1947. It was one of the pioneers in the indian insurance industry, playing a crucial role in providing insurance coverage to the nation. Here is a breakdown of the key milestones and achievements of the company.

- Oriental insurance company limited was formed as a government-owned general insurance company in india. Its primary objective was to provide insurance services to individuals, businesses, and corporations across the country.

- The company started its operations with a strong focus on meeting the insurance needs of the general public. It aimed to bridge the gap in the market by offering reliable and affordable insurance policies, ensuring financial security for policyholders.

- Over the years, oriental insurance company limited has established a wide network, both in terms of branches and tie-ups with agents and brokers. This extensive presence allows the company to reach out to customers in various cities and towns across india.

- The company’s dedication to customer service and its ability to adapt to the changing needs of society have been crucial in its growth and success. Oriental insurance company limited has consistently strived to be at the forefront of innovation in the industry, introducing new products and solutions to meet evolving market demands.

- Oriental insurance company limited has received numerous accolades and recognition for its excellence in the insurance sector. These include prestigious awards for its customer-centric approach, commitment to financial inclusivity, and contributions to the overall growth of the insurance market in india.

Overview Of The Company’S Mission And Vision

The mission of oriental insurance company limited is to provide reliable insurance solutions that cater to the diverse needs of its customers. The company aims to achieve this by:

- Ensuring financial security: Oriental insurance company limited aims to offer robust insurance coverage that provides individuals and businesses with much-needed financial security in times of unforeseen events.

- Promoting trust and transparency: The company operates on principles of trust and transparency, ensuring that policyholders have a clear understanding of their coverage and helping them make informed decisions about insurance.

- Encouraging innovation: Oriental insurance company limited believes in leveraging technology and adopting innovative practices to enhance its offerings and provide more efficient services to customers.

- Fostering long-term relationships: The company values long-term relationships with its customers, striving to build trust and loyalty through personalized assistance and prompt claim settlement.

- Contributing to society: Oriental insurance company limited is committed to giving back to society and actively supports various social causes and initiatives throughout the country.

By aligning its mission and vision with the ever-changing needs of customers, oriental insurance company limited continues to be a trusted name in the insurance industry, striving to provide comprehensive coverage and excellent service.

A Comprehensive Review Of Oriental Insurance Company Limited’S Policies

Discover the extensive range of policies and benefits offered by oriental insurance company limited through this informative review. Gain insights into their comprehensive coverage options and find the perfect policy to suit your insurance needs. Navigate the ins and outs of oriental insurance with ease and make an informed decision for a secured future.

Overview Of The Various Insurance Policies Offered By Oriental

Oriental insurance company limited provides a wide range of insurance policies to cater to different needs. Whether it’s health, motor, property, fire, travel, or specialized policies, oriental has got you covered. Let’s dive into the details of each policy and explore the benefits they offer.

Health Insurance Policies And Benefits:

- Health insurance: Oriental offers comprehensive health insurance policies that provide coverage for hospitalization expenses, pre and post-hospitalization costs, and ambulance charges.

- Critical illness cover: This policy provides financial protection against critical illnesses such as cancer, heart diseases, and kidney failure.

- Family floater policy: Oriental’s family floater policy covers the medical expenses of your entire family under a single sum insured.

- Senior citizen policy: Specifically designed for senior citizens, this policy covers age-related health issues and offers cashless hospitalization.

Motor Insurance Policies And Benefits:

- Two-wheeler insurance: Oriental provides insurance for two-wheelers, ensuring protection against accidental damage, theft, and third-party liability.

- Car insurance: With oriental’s car insurance policies, you can safeguard your vehicle against theft, damage, and accidents. It also offers third-party liability coverage.

- Commercial vehicle insurance: This policy caters to businesses that own commercial vehicles, providing coverage against accidents, theft, and third-party liabilities.

Property And Fire Insurance Policies And Benefits:

- Home insurance: Oriental’s home insurance policy protects your house and its contents from fire, natural calamities, burglary, and other perils.

- Fire insurance: This policy specifically covers damages caused by fire, ensuring financial security for homeowners and business establishments.

- Industrial all-risk insurance: Oriental’s industrial all-risk policy offers comprehensive coverage against a wide range of risks such as fire, explosion, machinery breakdown, and more.

Travel Insurance Policies And Benefits:

- Travel insurance: Oriental’s travel insurance provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related mishaps.

- Overseas mediclaim policy: Designed for individuals traveling abroad, this policy offers healthcare coverage, emergency medical evacuation, and more.

- Student travel insurance: Specifically designed for students studying abroad, this policy provides coverage for medical expenses, personal accidents, and study interruptions.

Other Specialized Policies And Benefits:

- Professional indemnity insurance: This policy protects professionals like doctors, lawyers, architects, and engineers from the financial repercussions of claims arising due to professional negligence.

- Marine cargo insurance: Oriental’s marine cargo policy provides coverage for goods and merchandise transported through various modes of transport.

- Liability insurance: This policy is designed to protect individuals and businesses from legal liabilities arising due to negligence, accidents, or injuries caused to third parties.

Oriental insurance company limited offers a comprehensive range of insurance policies to meet diverse needs. Whether it’s health, motor, property, fire, travel, or specialized insurance, oriental ensures that you and your assets are well-protected.

The Benefits And Advantages Of Choosing Oriental Insurance Company Limited

Oriental insurance company limited offers a range of policies and benefits, making it the ideal choice for insurance needs. With its extensive coverage options and excellent customer service, oriental insurance provides peace of mind and financial security for individuals and businesses alike.

Key Advantages Of Oriental Insurance Company Limited

Oriental insurance company limited offers a range of benefits and advantages to its customers. Let’s explore some of the key reasons why choosing oriental insurance can be a wise decision:

- Customer-centric approach and superior service delivery:

The company prides itself on its customer-centric approach, making sure that the needs and requirements of their customers are always given utmost priority. This translates into superior service delivery, as oriental insurance goes the extra mile to address customer queries, provide quick claim settlement, and offer personalized assistance throughout the insurance process.

- Expertise and experience in the insurance industry:

With decades of experience in the insurance sector, oriental insurance brings unparalleled expertise to the table. Their deep understanding of insurance products, regulations, and market trends allows them to offer comprehensive coverage options tailored to individual needs. Customers can trust in the company’s vast knowledge and proven track record when it comes to protecting their assets and mitigating risks.

- High claim settlement ratio and customer satisfaction:

Oriental insurance takes immense pride in its high claim settlement ratio, which reflects the company’s commitment to honoring genuine claims promptly. This not only provides financial security to policyholders but also instills trust and confidence in their insurance provider. The company’s focus on customer satisfaction is evident through positive testimonials and feedback from satisfied customers who have benefited from oriental insurance’s reliable and efficient claim settlement process.

By choosing oriental insurance company limited, customers can enjoy a range of advantages including a customer-centric approach, superior service delivery, expertise in the insurance industry, and a high claim settlement ratio. The company’s commitment to customer satisfaction and their wealth of experience make them a trusted insurance partner.

Protecting your assets and securing your future has never been easier with oriental insurance.

Understanding Oriental Insurance Company Limited’S Health Insurance Plans

Understanding health insurance plans offered by oriental insurance company limited is made easy with this comprehensive guide. Decode the policies and benefits to choose the best coverage for your healthcare needs. Protect yourself and your loved ones with oriental insurance company limited’s reliable health insurance options.

When it comes to health insurance, oriental insurance company limited offers a range of comprehensive plans to meet different needs. From individuals to families and even groups, their policies come with customizable options and attractive benefits. In this section, we will provide an overview of the health insurance offerings, coverage details, policy features, eligibility criteria, and age restrictions for oriental insurance company limited.

Overview Of Health Insurance Offerings:

- Oriental insurance company limited provides a diverse range of health insurance plans, catering to the specific needs of individuals, families, and groups.

- Their plans offer coverage for various medical expenses, including hospitalization expenses, pre and post-hospitalization costs, day care procedures, and more.

- The policies also include coverage for ambulance charges, organ donor expenses, and domiciliary hospitalization, ensuring comprehensive care for policyholders.

- With oriental insurance company limited, policyholders can choose from a wide network of hospitals and healthcare providers for cashless treatment, making it convenient and hassle-free.

Coverage Details And Policy Features:

- Oriental insurance company limited’s health insurance plans offer extensive coverage for both inpatient and outpatient medical expenses.

- Inpatient coverage includes room rent, icu charges, surgeon fees, anesthesia fees, diagnostic charges, and other related expenses.

- Outpatient coverage includes consultation fees, diagnostic tests, pharmacy bills, and vaccinations, among other expenses.

- Policyholders can also avail of additional benefits like maternity coverage, newborn baby coverage, and coverage for specific illnesses.

- Some policies may provide coverage for alternative treatments like ayurveda, homeopathy, and unani, along with allopathic treatments.

- Oriental insurance company limited offers the flexibility to choose the sum insured amount based on the policyholder’s requirements and budget.

Eligibility Criteria And Age Restrictions:

- To be eligible for oriental insurance company limited’s health insurance plans, individuals must be indian residents.

- The minimum entry age for most health insurance plans is 18 years, while the maximum entry age varies between 65 to 70 years, depending on the specific policy.

- The maximum renewal age for these policies is usually 80 years, ensuring continued coverage for policyholders as they age.

Customizable Options For Individuals, Families, And Groups:

- Oriental insurance company limited understands that every individual or group has unique healthcare needs. Hence, their health insurance plans can be customized to suit specific requirements.

- Individuals can choose plans that cater to their personal needs, while families can opt for policies that cover all family members under a single plan.

- Oriental insurance company limited also offers group health insurance plans that provide coverage to members of organizations or companies.

- Customizable options allow policyholders to tailor their plans based on factors like sum insured, coverage features, add-ons, and premium amounts.

Oriental insurance company limited’s health insurance plans offer comprehensive coverage for individuals, families, and groups, ensuring financial protection against medical expenses. With customizable options, attractive benefits, and a wide network of hospitals, their policies provide peace of mind and security in times of need.

Key Benefits And Features Of Oriental Insurance Company Limited’S Health Insurance Policies

Oriental insurance company limited offers a range of health insurance policies with key benefits and features. These policies provide comprehensive coverage, including cashless hospitalization, pre and post-hospitalization expenses, and coverage for critical illnesses. With oriental insurance, you can ensure the financial well-being of yourself and your loved ones in times of medical emergencies.

Oriental insurance company limited offers a range of comprehensive health insurance policies that come with a variety of key benefits and features. These policies are designed to provide financial protection and peace of mind during medical emergencies. Let’s take a closer look at some of the notable benefits and features offered by oriental insurance company limited:

Hospitalization Coverage And Cashless Facility:

- Hospitalization coverage: Oriental insurance company limited’s health insurance policies provide coverage for both planned and emergency hospitalization expenses, ensuring that you and your loved ones receive the necessary medical care without worrying about the financial burden.

- Cashless facility: With oriental insurance company limited, policyholders can avail the cashless facility at network hospitals, where the insurance company settles the medical bills directly with the hospital, eliminating the need for policyholders to pay out-of-pocket and then seek reimbursement.

Coverage For Pre-Existing Illnesses And Maternity Expenses:

- Pre-existing illnesses coverage: Oriental insurance company limited understands the importance of covering pre-existing illnesses. Their health insurance policies offer coverage for pre-existing illnesses after a waiting period, helping you manage your existing medical conditions.

- Maternity expenses coverage: Oriental insurance company limited’s health insurance policies also provide coverage for maternity expenses, including pre and post-natal care, delivery charges, and newborn baby coverage. This ensures that expectant mothers can avail quality healthcare without any worries.

Ambulance Charges And Emergency Medical Services:

- Ambulance charges coverage: Oriental insurance company limited’s health insurance policies cover ambulance charges, providing financial assistance during an emergency or the need for medical transportation.

- Emergency medical services: In case of medical emergencies, oriental insurance company limited offers immediate assistance through their emergency medical services, ensuring timely access to medical care and treatment.

Additional Benefits And Riders For Enhanced Coverage:

- Additional benefits: Oriental insurance company limited’s health insurance policies may come with additional benefits such as coverage for alternative treatments, domiciliary hospitalization, and health check-ups. These additional benefits provide a well-rounded coverage for policyholders.

- Riders for enhanced coverage: Oriental insurance company limited also offers riders or add-on options that policyholders can opt for to enhance their coverage. These riders could include critical illness coverage, personal accident cover, and others, providing added financial protection.

Oriental insurance company limited’s health insurance policies offer a wide range of benefits and features to cater to different healthcare needs. From comprehensive hospitalization coverage and cashless facility to coverage for pre-existing illnesses, maternity expenses, ambulance charges, emergency medical services, and additional benefits, their policies aim to provide holistic coverage and peace of mind.

How To Choose The Right Health Insurance Plan From Oriental Insurance Company Limited?

Gain clarity on selecting the perfect health insurance plan from oriental insurance company limited. Uncover the array of policies and benefits offered by the company to make an informed decision about your healthcare coverage.

When it comes to securing the right health insurance plan, there are several factors you need to consider. The oriental insurance company limited offers a range of policies, each with its own unique benefits. To help you make an informed decision, we have outlined the key factors to consider, steps to compare and evaluate different policies, and tips for finding the best coverage at affordable premiums.

Factors To Consider When Selecting A Health Insurance Plan:

- Coverage: Assess what medical expenses are covered, such as hospitalization, surgeries, medications, and pre-existing conditions.

- Sum insured: Determine the maximum amount the insurance company will pay for covered expenses in a policy year.

- Network hospitals: Check if the insurance plan offers a wide network of hospitals, clinics, and healthcare providers.

- Waiting periods: Understand any waiting periods for pre-existing conditions, maternity benefits, and specific treatments.

- Co-payment and deductibles: Evaluate if the plan includes a co-payment clause or deductibles, which require you to pay a percentage or fixed amount towards medical expenses.

Steps To Compare And Evaluate Different Policies:

- Research: Gather information about the different health insurance policies offered by oriental insurance company limited.

- Assess your needs: Determine your healthcare requirements and identify the coverage options that align with them.

- Compare coverage and premiums: Evaluate the coverage provided by each policy and compare it to the premiums charged.

- Check add-ons: Look for additional benefits or add-ons such as critical illness coverage or wellness programs.

- Read the fine print: Carefully review the policy documents, including terms, conditions, and exclusions.

- Seek expert advice: Consult an insurance advisor to get a clear understanding of the policy’s terms and conditions.

- Consider customer reviews: Read reviews from existing policyholders to gauge their satisfaction and experience with the company.

Tips For Finding The Best Coverage At Affordable Premiums:

- Assess your needs: Determine the coverage you require based on your health condition, lifestyle, and financial capability.

- Compare policies: Collect quotes from multiple insurers and compare the coverage, benefits, premiums, and add-ons.

- Consider family plans: If you have dependents, explore family insurance policies that provide comprehensive coverage for all members.

- Look for cashless facilities: Opt for a plan that offers cashless hospitalization, ensuring easier claim settlements.

- Avail of no claim bonus: Check if the policy offers a no claim bonus, which increases the sum insured for every claim-free year.

- Utilize online tools: Make use of online insurance comparison tools to streamline the process of finding the best plan.

- Read reviews and ratings: Research customer reviews and ratings to understand the insurer’s claim settlement history and customer service.

By considering these factors, following the evaluation steps, and implementing the tips mentioned, you can choose a health insurance plan from oriental insurance company limited that provides optimal coverage at affordable premiums. Remember, prioritizing your healthcare needs and comparing policies will help you make the right decision to safeguard your well-being and financial security.

Overview Of Oriental Insurance Company Limited’S Motor Insurance Plans

Oriental insurance company limited offers a range of motor insurance plans that provide comprehensive coverage and various benefits. Explore their policies to find the perfect insurance plan for your vehicle.

Overview Of Oriental Insurance Company Limited’S Motor Insurance Plans:

Oriental insurance company limited offers a range of motor insurance plans to cater to the diverse needs of its customers. Whether you own a two-wheeler or a four-wheeler, the company has you covered with comprehensive coverage options. Let’s take a closer look at the types of motor insurance offered by oriental and the coverage they provide:

Types Of Motor Insurance Offered By Oriental:

- Third-party liability coverage: Oriental insurance company limited offers third-party liability coverage for both two-wheelers and four-wheelers. This policy protects you against any legal liability arising due to bodily injury or property damage caused to a third party. It ensures that you are financially protected in case of any unfortunate mishap.

- Comprehensive coverage: Oriental insurance company limited also provides comprehensive coverage for both two-wheelers and four-wheelers. This policy not only covers third-party liability but also provides additional protection for your own vehicle. It safeguards you against losses due to accidents, theft, fire, natural disasters, and other unforeseen events.

Coverage For Two-Wheelers And Four-Wheelers:

When it comes to insuring your two-wheeler or four-wheeler, oriental insurance company limited has you covered. Here’s a breakdown of the coverage options available:

- Two-wheeler insurance: Oriental offers comprehensive insurance coverage for two-wheelers, ensuring that you have comprehensive protection for your valuable asset. Whether you own a motorcycle, scooter, or moped, you can benefit from the peace of mind that comes with robust insurance coverage.

- Four-wheeler insurance: Oriental insurance company limited provides comprehensive coverage options for four-wheelers, including cars, suvs, and commercial vehicles. Whether you use your vehicle for personal or commercial purposes, oriental’s motor insurance plans offer the necessary protection against various risks and liabilities.

Oriental insurance company limited offers a range of motor insurance plans designed to meet the diverse needs of vehicle owners. With options for both two-wheelers and four-wheelers, including comprehensive coverage and third-party liability protection, oriental ensures that you can enjoy the road ahead confidently.

Understanding The Benefits And Features Of Oriental Insurance Company Limited’S Motor Insurance Policies

Discover the advantages and unique features of oriental insurance company limited’s motor insurance policies. From comprehensive coverage to hassle-free claims, their policies provide peace of mind on the road. Navigate through the intricacies of their offerings for a seamless insurance experience.

Oriental insurance company limited offers a range of motor insurance policies that provide comprehensive coverage, ensuring peace of mind for vehicle owners. Let’s take a closer look at the key benefits and features of their motor insurance policies:

Coverage For Own Damage And Theft:

- Comprehensive protection against damages caused to your vehicle in accidents, natural calamities, or fire.

- Coverage for theft of your vehicle or any of its components.

- Repairs and reimbursement for damages or losses incurred due to acts of vandalism.

Personal Accident Cover And Legal Liability:

- Protection against personal injuries sustained by the policyholder or any authorized driver.

- Financial assistance for medical treatment and compensation for permanent disabilities or death.

- Legal liability coverage for damages caused by the insured vehicle to third-party property or individuals.

No Claim Bonus And Additional Benefits:

- No claim bonus (ncb) is a reward given to policyholders who haven’t made any claims during the policy term.

- Ncb can be accumulated over the years, resulting in significant discounts on premium payments for subsequent renewals.

- Additional benefits such as roadside assistance, emergency towing services, and coverage for personal belongings in the insured vehicle.

Assistance Services And Add-Ons For Comprehensive Plans:

- 24×7 helpline for immediate assistance in case of accidents or breakdowns.

- Cashless claim settlement at network garages, reducing the financial burden on the policyholder.

- Optional add-ons like zero depreciation cover, engine protect, and return to invoice, which provide enhanced protection and peace of mind.

By opting for oriental insurance company limited’s motor insurance policies, you can safeguard your vehicle against unforeseen events, ensuring a worry-free experience on the road. Explore their range of policies to choose the one that meets your specific needs and enjoy the benefits of comprehensive coverage and reliable assistance services.

How To Make An Informed Decision While Choosing Motor Insurance From Oriental Insurance Company Limited?

Motor insurance from oriental insurance company limited offers various policies and benefits. To make an informed decision, carefully analyze their policies, compare premiums, coverage options, and claim settlement processes. Don’t forget to consider your specific requirements and budget while choosing your motor insurance.

Factors To Consider When Selecting A Motor Insurance Plan

- Coverage options: Evaluate the different types of coverage offered by oriental insurance company limited for motor insurance. Consider whether they meet your specific needs and requirements.

- Premium rates: Compare the premium rates of different motor insurance plans offered by oriental insurance company limited. Take into account factors such as your vehicle’s age, make and model, as well as your own driving history and experience.

- Deductibles and excess: Understand the deductibles and excess amounts associated with the motor insurance plans. This will help you determine how much you will have to pay out of pocket in the event of a claim.

- Add-on features: Explore the additional features and benefits available with each motor insurance plan. These may include roadside assistance, zero depreciation cover, or coverage for accessories and personal belongings.

- Network of garages: Check the network of garages that oriental insurance company limited has tied up with for cashless servicing. Make sure that there are sufficient garages near your location for easy access in case of an emergency.

Tips For Evaluating Coverage And Premiums

- Assess your needs: Determine the level of coverage you require based on factors such as the value of your vehicle, the risks associated with your daily commute, and your budget.

- Read policy documents carefully: Thoroughly go through the policy documents and understand the terms and conditions, inclusions, and exclusions associated with the coverage. This will help you make an informed decision and avoid any surprises later on.

- Compare quotes: Obtain quotes for different motor insurance plans from oriental insurance company limited. Compare the coverage offered as well as the premium rates to find the best option for you.

- Consider claim settlement ratio: Research the claim settlement ratio and customer reviews of oriental insurance company limited. A higher settlement ratio indicates the company’s efficiency in processing claims and providing a hassle-free experience.

- Seek expert advice: If you are unsure about which motor insurance plan suits your needs best, consult with an insurance advisor or agent who can provide personalized guidance and recommendations.

Steps To Get A Quote And Purchase The Policy Online

- Visit the oriental insurance company limited website and navigate to the motor insurance section.

- Fill in the required details such as your vehicle’s make, model, year of manufacture, and registration number.

- Select the type of coverage you desire and any additional add-on features you want to include.

- Input your personal details, contact information, and address for communication purposes.

- Review the quote generated based on the information provided.

- Make any necessary modifications or customizations to the coverage and review the revised quote.

- Proceed to make the payment online using the available payment options.

- Upon successful payment, you will receive the policy documents via email or can download them directly from the website.

- Keep a copy of the policy documents handy and ensure that you understand the coverage and terms mentioned.

- In case of any queries or assistance required, reach out to oriental insurance company limited’s customer support helpline, available 24/7.

Frequently Asked Questions On Decoding Oriental Insurance Company Limited: Policies And Benefits

How Do I Check The Status Of My Oriental Insurance Claim?

To check the status of your oriental insurance claim, follow these steps: 1. Visit the official oriental insurance website. 2. Look for the “claim” or “claims status” section. 3. Click on the link provided to access the claim status page. 4.

Provide the required information, such as your policy number and claim details. 5. Submit the information and wait for the page to display the status of your claim. 6. If the status is not available online, contact oriental insurance’s customer service for further assistance.

By following these steps, you can easily check the status of your oriental insurance claim and stay updated on its progress.

Who Is The Owner Of Oriental Insurance?

The oriental insurance is a government-owned insurance company in india.

What Is Insured Code?

An insured code refers to a type of coverage provided by an insurance policy to protect against losses resulting from damaged or destroyed computer code. This coverage is typically included in cybersecurity or technology-specific insurance policies. The insured code coverage helps businesses recover from financial losses arising due to software glitches, hacking, virus attacks, or other cyber incidents that cause damage to the code.

In the event of a covered claim, the insurance company compensates the policyholder for expenses associated with repairing the code, restoring function, or rebuilding the system. It is important for businesses to assess their specific needs and consider purchasing the appropriate insurance coverage to safeguard their software assets from potential risks and financial harm.

What Are The Functions Of Oriental Insurance Company?

The oriental insurance company serves various functions including providing insurance coverage for individuals and businesses. It offers a wide range of insurance policies such as health, motor, property, liability, travel, and personal accident insurance. The company ensures financial protection and support during unforeseen events like accidents, natural disasters, or health issues.

It also assists in risk management by evaluating the risk exposure of individuals and businesses and formulating appropriate insurance solutions. Oriental insurance focuses on providing prompt and efficient claim settlement to its policyholders. With a strong network of branches and tie-ups with hospitals and service providers, the company is committed to delivering quality customer service.

Additionally, it engages in constant innovation to improve its products and processes, aiming to meet the evolving needs of its customers.

Conclusion

Oriental insurance company limited offers a wide range of policies and benefits that cater to the diverse needs of its customers. Whether it’s health, motor, travel, or property insurance, oriental insurance has comprehensive coverage options to provide financial security and peace of mind.

The company’s customer-centric approach ensures prompt and hassle-free claim settlement, making it a trustworthy choice for individuals and businesses alike. With a strong presence in india and a robust network of branches, oriental insurance is committed to serving its customers with excellence.

By choosing oriental insurance, you are not only protecting your assets and loved ones but also gaining access to a reliable partner that values your well-being. So, explore oriental insurance policies today and take the first step towards a secure future.