Manage your finances with ease by utilizing icici bank net banking, a convenient and efficient platform. Icici bank’s net banking service allows you to effortlessly handle all your banking needs in one place, ensuring seamless transactions, easy bill payments, and simplified access to account information.

With user-friendly navigation and robust security measures, icici bank net banking empowers you to take control of your financial management effortlessly. Whether you want to check your account balance, transfer funds, or set up recurring payments, icici bank net banking provides the tools you need to manage your finances efficiently.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7AIAMXOGJVNV7KIOVUFA6HJZTQ.jpg)

Credit: www.reuters.com

The Benefits Of Icici Bank Net Banking

Manage your finances effortlessly with icici bank net banking, enjoying the benefits of easy online transactions, secure bill payments, and convenient account balance tracking. Experience seamless banking with just a few clicks.

Convenient Access To Your Finances

Enjoy the ease and convenience of managing your finances anytime, anywhere with icici bank net banking. With just a few clicks, you can access a wide range of banking services and take control of your financial transactions at your fingertips.

- Check your account balance: Stay updated on your account balance by accessing it online without the need to visit a branch or atm.

- View transaction history: Track your financial activities by reviewing your transaction history online, allowing you to monitor your spending and maintain a clear record.

- Transfer funds: Easily transfer funds between your icici bank accounts or to other banks securely and swiftly, avoiding the hassle of tiresome paperwork and lengthy queues.

- Pay bills: Say goodbye to long queues and missed due dates by using icici bank net banking to pay your utility bills, credit card bills, and other payments conveniently.

- One-click investments: Seamlessly invest in mutual funds, fixed deposits, and recurring deposits with just a few clicks through icici bank net banking, making your financial planning hassle-free.

Secure And Reliable Platform

Rest assured knowing that icici bank net banking prioritizes the security and reliability of your financial transactions. Your information is protected by advanced encryption technology, which ensures that your data remains safe and confidential.

- Two-factor authentication: Icici bank net banking employs an added layer of security with two-factor authentication, incorporating your unique credentials and a second verification factor to prevent unauthorized access.

- Secure login credentials: Create a strong password and safeguard your account by regularly changing it to protect against potential security breaches.

- Secure online transactions: Enjoy peace of mind while conducting online transactions through icici bank net banking, as your financial details are encrypted and protected from potential threats.

- Protected against fraud: Icici bank net banking offers comprehensive security measures to safeguard your account against any fraudulent activities, ensuring that your hard-earned money remains secure.

- Regular security updates: Benefit from the constant enhancements and updates made to icici bank net banking’s security measures, guaranteeing a safe and reliable platform for managing your finances.

Time-Saving Features For Everyday Banking Tasks

Icici bank net banking provides time-saving features designed to simplify your everyday banking tasks. Take advantage of these features to streamline your financial management and save valuable time.

- Online account opening: Open a new account online without visiting a branch, reducing paperwork and saving you time.

- Instant fund transfer: Transfer funds instantly to registered payees without any delays, eliminating unnecessary waiting periods.

- Automatic bill payments: Set up automatic bill payments to reduce manual effort and avoid late payments. Icici bank net banking allows you to schedule recurring payments for your bills, such as electricity, telephone, and insurance.

- E-statements: Opt for paperless banking by accessing your account statements online. Icici bank net banking provides e-statements, which are eco-friendly and convenient to access and store.

- Personalized dashboard: Customize your dashboard to display your preferred banking services and frequently accessed features for quick access, personalized according to your preferences.

Experience the convenience, security, and time-saving benefits of icici bank net banking to manage your finances with ease. Take advantage of these features and simplify your everyday banking tasks by accessing your account online, securely and conveniently.

How To Set Up Icici Bank Net Banking

Discover how to easily set up icici bank net banking and take control of your finances with convenience. Simply follow the step-by-step process and get started today.

Step-By-Step Guide For Creating An Account

Setting up your icici bank net banking account is a simple and straightforward process. Follow the step-by-step guide below to get started with managing your finances with ease:

- Visit the official icici bank website.

- Click on the “personal” tab located on the top menu bar.

- From the drop-down menu, select “internet banking.”

- On the internet banking page, click on the “login” button.

- In the “username/user id” field, enter your icici bank account number.

- Next, enter your registered mobile number in the “mobile number” field.

- Click on the “get password” button.

- You will receive an sms with a one-time password (otp) on your registered mobile number.

- Enter the otp in the “otp” field on the website.

- Create a strong and secure login password as per the specified criteria.

- Re-enter the password to confirm.

- Select a security question from the drop-down menu and provide the answer.

- Click on the “submit” button to complete the account creation process.

Congratulations! You have successfully set up your icici bank net banking account. Now, let’s move on to the activation and verification process to access all the features and services.

Activation And Verification Process

After creating your icici bank net banking account, it is important to activate and verify your account to ensure a seamless online banking experience. Follow these steps to activate and verify your account:

- Log in to your icici bank net banking account using your user id and password.

- On the main dashboard, you will find a tab for “account services.” Click on it.

- From the drop-down menu, select “my profile” and click on the “update profile” option.

- Navigate to the “contact details” section and click on the “update” button.

- Verify and update your email address and mobile number, if required.

- Follow the instructions provided to complete the verification process for your email and mobile number.

- Once verification is complete, you will receive a confirmation message on your registered email and mobile number.

- Your icici bank net banking account is now activated and verified, and you can start using all the features and services available to you.

Exploring The Different Login Options

Icici bank net banking offers various login options to cater to different user preferences. Let’s explore these options:

- User id and password: This is the most common login method where you use your registered user id and password to access your account.

- Mobile banking app: Icici bank offers a user-friendly mobile app that allows you to access your account anytime, anywhere using your mobile device.

- Fingerprint/touch id login: If your mobile device supports biometric authentication, you can enable the fingerprint/touch id login feature for quicker and more secure access.

- One-time password (otp) login: In certain cases, such as accessing your account from a new device, you may receive an otp on your registered mobile number to authenticate your login.

- Secure access code (sac): Icici bank provides an additional security layer through sac, which is a unique code sent to your registered mobile number for login verification.

Choose the login option that suits your convenience and enjoy the seamless banking experience with icici bank net banking.

Start managing your finances with ease today by setting up your icici bank net banking account. With a few simple steps, you can gain access to a wide range of banking services and enjoy the convenience of online banking.

Exploring The Features Of Icici Bank Net Banking

Discover the convenience of managing your finances with ease through icici bank net banking. Explore its wide range of features for a seamless online banking experience.

Overview Of The Dashboard And Account Summary

- The dashboard is the central hub of your icici bank net banking experience, giving you a comprehensive view of your finances at a glance.

- It provides real-time updates on your account balance, recent transactions, and investment details.

- You can customize the dashboard to display the information that is most important to you, making it easier to manage your finances efficiently.

- The account summary section provides a detailed overview of all your accounts, including savings, current, and fixed deposit accounts.

Fund Transfer Options Within And Outside The Bank

- Icici bank net banking offers a range of fund transfer options, allowing you to conveniently transfer money between your own accounts or to other icici bank accounts.

- You can also transfer funds to accounts in other banks within india using neft, rtgs, or imps.

- With icici bank’s seamless international fund transfer facility, you can easily send money to bank accounts abroad.

- The process is secure and hassle-free, ensuring that your funds reach the intended recipient without any delays.

Online Bill Payment And Utility Services

- Say goodbye to long queues and overdue payments with icici bank’s online bill payment service.

- You can pay your electricity, water, gas, and telephone bills conveniently from the comfort of your home.

- Icici bank net banking also allows you to set up automatic bill payments, ensuring that your bills are always paid on time.

- In addition to bill payments, you can also enjoy utility services like mobile recharge, dth recharge, and data card recharge directly through your net banking account.

Introduction To The E-Statements And Tax Filing Features

- Icici bank net banking provides the convenience of e-statements, eliminating the need for paper statements.

- You can easily access your bank statements online at any time, keeping track of your expenses and transactions.

- The e-statements are secure, password-protected, and available in pdf format for easy download and printing, if needed.

- When it comes to tax filing, icici bank net banking simplifies the process by providing a dedicated section for tax-related services.

- You can easily file your income tax returns online, saving time and avoiding the hassle of paperwork.

Using Icici Bank Net Banking For Everyday Banking

Manage your finances effortlessly with icici bank net banking, making everyday banking a breeze. Easily access and handle your financial transactions online with this user-friendly service.

Wouldn’t it be wonderful if managing your finances could be quick, hassle-free, and accessible right at your fingertips? With icici bank net banking, you can seamlessly handle all your everyday banking needs from the comfort of your own home or on the go.

Let’s explore the various features and benefits that make icici bank net banking the perfect companion for your financial management.

Making Quick And Hassle-Free Payments:

- Pay your bills, utility bills, and credit card bills with just a few clicks.

- Transfer funds instantly to family, friends, or business associates.

- Schedule one-time payments effortlessly, avoiding the hassle of manual transactions.

- Set up standing instructions for recurring payments, ensuring timely bill payments without any effort.

Scheduling Recurring Payments And Standing Instructions:

- Simplify your life by setting up recurring payments for regular bills like rent, electricity, or insurance premiums.

- Customize the frequency and amount of these payments according to your preferences.

- Say goodbye to missed payments and late fees with automated standing instructions.

- Manage your expenses effectively by planning ahead and avoiding last-minute hassles.

Managing Multiple Accounts And Beneficiaries:

- Access all your accounts, including savings, current, and fixed deposits, in one single dashboard.

- Transfer funds conveniently between your accounts without any hassle.

- Add and manage multiple beneficiaries for a seamless and secure transfer experience.

- Stay in control of your finances by easily monitoring and managing all your accounts at a glance.

Tracking Transaction History And Account Balances:

- Keep a close eye on your financial activities with real-time transaction tracking.

- View detailed transaction histories, including debits, credits, and other relevant information.

- Get instant updates on your account balances, ensuring you stay informed about your financial status.

- Export transaction statements for easy record-keeping and analysis.

With icici bank net banking, managing your finances has never been easier. Take advantage of these features and enjoy the convenience, efficiency, and security that come with it. Say goodbye to long queues, paperwork, and unnecessary stress. Embrace the future of banking and experience the power of seamless financial management with icici bank net banking.

Remember, your financial peace of mind is just a few clicks away!

Advanced Features For Financial Management

Manage your finances effortlessly with icici bank net banking’s advanced features for financial management. Stay in control of your money with ease and convenience.

Managing your finances has become easier than ever with the advanced features offered by icici bank’s net banking platform. With a range of options to suit your needs, you can customize your budgeting, track your financial goals, invest, and access loan and credit card information, all in one place.

Let’s explore the advanced features that make icici bank net banking the go-to platform for efficient financial management.

Customizing Budgeting And Spending Categories

- Create personalized budgeting categories to ensure effective money management.

- Allocate specific amounts to each category to keep track of your spending.

- Monitor and analyze your expenses by viewing detailed reports and charts.

Setting Financial Goals And Tracking Progress

- Define short-term and long-term financial goals to achieve at your own pace.

- Track your progress and stay motivated by regularly reviewing your goal achievements.

- Receive notifications and reminders to help you stay on track and achieve your goals.

Investing Through The Net Banking Platform

- Explore a variety of investment options such as mutual funds, stocks, and fixed deposits.

- Get access to real-time market data and tools to make informed investment decisions.

- Invest securely and conveniently through the net banking platform, without the need for additional accounts or intermediaries.

Accessing Loan And Credit Card Information

- View and manage your loan and credit card accounts effortlessly.

- Check your outstanding balance, payment due dates, and repayment history.

- Make hassle-free payments directly from the net banking platform.

Icici bank net banking brings together all the essential tools and features you need to effectively manage your finances. Take advantage of the advanced features and make the most of your financial journey. Start now and experience the convenience of icici bank net banking.

Remember, financial management is made easy when you have the right tools at your fingertips.

Security Measures And Tips For Safe Net Banking

Secure your finances with ease through icici bank net banking. Follow these security measures and tips for safe online banking to protect your valuable information and transactions. Stay vigilant and ensure a worry-free banking experience.

Understanding The Multi-Factor Authentication Process:

- The multi-factor authentication process adds an extra layer of security to your icici bank net banking account. It helps ensure that only the authorized account holder can access the account. Here’s how it works:

- Step 1: When you try to log in to your net banking account, you will be prompted to enter your username and password, which serve as the first level of authentication.

- Step 2: After providing your login credentials, you will receive a one-time password (otp) on your registered mobile number. This otp serves as the second level of authentication and must be entered to complete the login process.

- Step 3: In some cases, icici bank may also utilize biometric authentication methods, such as fingerprint or facial recognition, as an additional layer of security.

- Step 4: Once you’ve successfully completed the multi-factor authentication process, you can access your net banking account and manage your finances with ease.

Tips For Creating Strong And Secure Passwords:

- Creating a strong and secure password is crucial for protecting your icici bank net banking account from unauthorized access. Here are some tips to help you create a robust password:

- Use a combination of uppercase and lowercase letters, numbers, and special characters.

- Avoid using common words, personal information, or consecutive keyboard patterns as your password.

- Make your password at least 8-12 characters long.

- Regularly update your password and avoid reusing old passwords.

- Consider using a password manager to generate and store complex passwords securely.

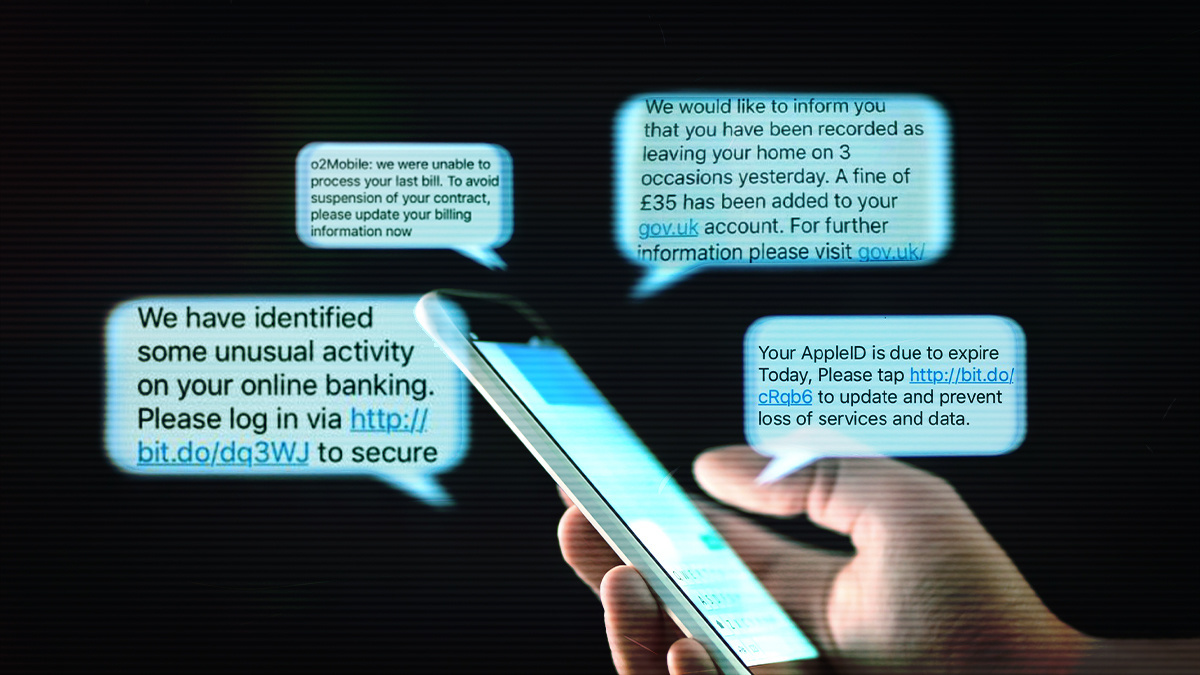

Protecting Personal Information And Avoiding Phishing Scams:

- Safeguarding your personal information is essential when using icici bank net banking. Here’s how you can protect yourself from phishing scams and unauthorized access:

- Be vigilant about sharing your net banking credentials, including username, password, and otp, with anyone.

- Avoid clicking on suspicious links or downloading attachments from unknown sources, as they may contain malware or direct you to phishing websites.

- Verify the authenticity of emails or messages claiming to be from icici bank before providing any personal information.

- Regularly update your contact details with the bank to receive important security alerts and notifications.

- Enable transaction alerts and regularly monitor your account for any unauthorized activity.

- If you suspect any fraudulent activity, immediately report it to icici bank customer support.

Regularly Monitoring Account Activity And Reporting Suspicious Incidents:

- Monitoring your icici bank net banking account regularly and reporting any suspicious incidents can help ensure the security of your finances. Here’s what you need to do:

- Regularly review your account statements and transaction history to identify any unauthorized transactions.

- Report any suspicious activity, such as unexpected transfers or unfamiliar payees, to icici bank immediately.

- Keep track of your login activity and ensure there are no unauthorized access attempts on your account.

- Familiarize yourself with the process of reporting fraud or unauthorized transactions to icici bank and follow their instructions promptly.

- Be proactive in keeping your contact details up to date with the bank to receive timely alerts regarding your account activity.

Troubleshooting And Support For Icici Bank Net Banking

Ensure smooth management of your finances with icici bank net banking. Get troubleshooting and support to resolve any issues you may encounter, ensuring uninterrupted access to your accounts.

If you ever encounter issues while using icici bank net banking, you don’t need to worry. The bank offers several options for troubleshooting and support to ensure a seamless online banking experience. From common issues faced by users and their solutions to contacting customer support, as well as exploring the online help center and faqs, there are various avenues you can explore for assistance.

Common Issues Faced By Users And Their Solutions:

- Login problems: If you are having trouble logging into your icici bank net banking account, ensure that you are entering the correct login credentials. If the issue persists, try resetting your password or contact customer support for further assistance.

- Account balance discrepancies: If you notice any discrepancies in your account balance, such as missing transactions or incorrect figures, check if the transactions have been processed. In case of any discrepancy, reach out to customer support to resolve the issue.

- Transaction errors: If you encounter errors while making transactions through icici bank net banking, ensure that you have entered the correct details and have a stable internet connection. If the error persists, contact customer support for guidance.

- Technical glitches: Sometimes, technical glitches may impede your online banking experience. In such cases, try clearing your browser cache and cookies or switching to a different browser. If the issue persists, contact customer support for technical assistance.

Contacting Customer Support For Assistance:

If you need assistance with any aspect of icici bank net banking, you can easily reach out to their customer support team. Here are the available methods to get in touch:

- Call their customer care helpline at [provide customer care number] for immediate assistance.

- Visit the nearest icici bank branch and speak to a representative in person.

- Reach out to them through their official social media channels, such as twitter or facebook, and send a direct message explaining your issue.

Exploring The Online Help Center And Faqs:

Icici bank provides an online help center and comprehensive faqs section to address various queries and concerns. Here’s how you can make the most of these resources:

- Go to the icici bank website and navigate to the ‘support’ or ‘help center’ section.

- Search for relevant topics or keywords to find answers to your queries.

- Browse through the faqs to find solutions to common problems faced by icici bank net banking users.

- If you can’t find the answers you’re looking for, consider contacting customer support for further assistance.

Remember, if you come across any issues or need support while using icici bank net banking, troubleshooting is just a step away. Take advantage of the resources available to ensure a smooth and hassle-free online banking experience.

Frequently Asked Questions Of Icici Bank Net Banking: Manage Your Finances With Ease

How Can I Activate My Icici Debit Card For Online Transaction?

To activate your icici debit card for online transactions, follow these simple steps: log in to your icici internet banking account. Select the “cards” option and then click on “debit cards. ” Choose the “manage card settings” option. Select the debit card you want to activate and click on “activate now.

” Enter the details asked for, such as your card’s cvv number, expiry date, and date of birth. Click on “submit” to complete the activation process. You will receive an otp on your registered mobile number. Enter the otp on the screen to verify your identity.

Once verified, your icici debit card will be activated for online transactions. Enjoy secure and hassle-free online shopping with your activated icici debit card.

How Do I Login To Icici Net Banking?

To log in to icici net banking, follow these steps: 1. Visit the icici bank website. 2. Click on the “login” button on the top right corner of the homepage. 3. Select the type of account you have, such as savings account, current account, or credit card.

4. Enter your user id and password in the required fields. 5. Click on the “login” button. 6. If it’s your first time logging in, you will be prompted to set a new password. 7. Follow the on-screen instructions to complete the login process.

8. Once logged in, you can access and manage your icici bank account online, view balances, make transactions, pay bills, and more. Remember to keep your login credentials secure and change your password regularly for enhanced security.

How Can I Manage My Transaction Limit In Icici Net Banking?

To manage your transaction limit in icici net banking, follow these steps: 1. Log in to your icici net banking account. 2. Navigate to the ‘service requests’ section. 3. Locate and select the ‘transaction limit’ option. 4. review your existing transaction limits.

5. If you need to increase or decrease your limit, click on the respective option. 6. Provide the necessary details, such as the revised limit amount. 7. Submit the request, and it will be processed by icici bank. 8. You will receive a confirmation message once your transaction limit has been updated.

It is important to manage your transaction limit to ensure the security of your account and prevent any unauthorized transactions. By following these steps, you can easily modify your transaction limit as per your requirements.

How To Change The Standing Instruction In Icici Net Banking?

To change the standing instruction in icici net banking, follow these steps: 1. Log in to your icici net banking account. 2. Go to the “payments and transfer” section. 3. Click on “manage standing instructions. ” 4. Select the account for which you want to change the standing instruction.

5. Choose the type of standing instruction you want to modify. 6. Click on the “edit” option next to the selected standing instruction. 7. Make the necessary changes to the standing instruction details. 8. review the changes and click on “submit” to save the modifications.

9. You will receive a confirmation message once the standing instruction has been successfully updated. Please note that the specific steps may slightly vary based on the version of icici net banking you are using.

Conclusion

Icici bank net banking is a game-changer in the financial industry, allowing users to effortlessly manage their finances from the comfort of their homes. With features like easy and secure login, instant fund transfers, online bill payments, and 24/7 customer support, this platform offers convenience and peace of mind.

Users can also enjoy the benefits of personalized banking with customizable dashboards and budgeting tools. Moreover, icici bank ensures the highest level of security with advanced encryption technology and two-factor authentication. Whether you are an individual looking for a convenient way to manage your money or a business seeking efficient financial solutions, icici bank net banking is the answer.

Start exploring the endless possibilities and take control of your finances today. With icici bank net banking, your financial management journey is just a few clicks away.